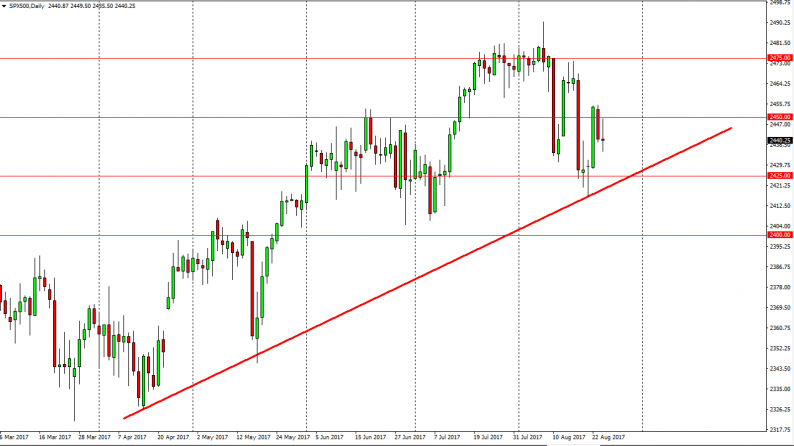

S&P 500

The S&P 500 went back and forth during the Thursday session, testing the 2450 level, and then pulling back. I think that the neutral candle suggests that we are waiting for words out of Janet Yellen to decide where to go next. After all, Federal Reserve policy will be important involving the dollar and interest rates, but I think given enough time, the buyers will probably return on dips as we continue to see. There has been a bit of a choppy moved to the lower end now, and testing the uptrend line, but part of this might be due to low volume at the end of summer. Ultimately, if we break above the 2450 level the market should continue to go much higher. I have no interest in shorting until we get below the 2410 level which would be a very negative sign.

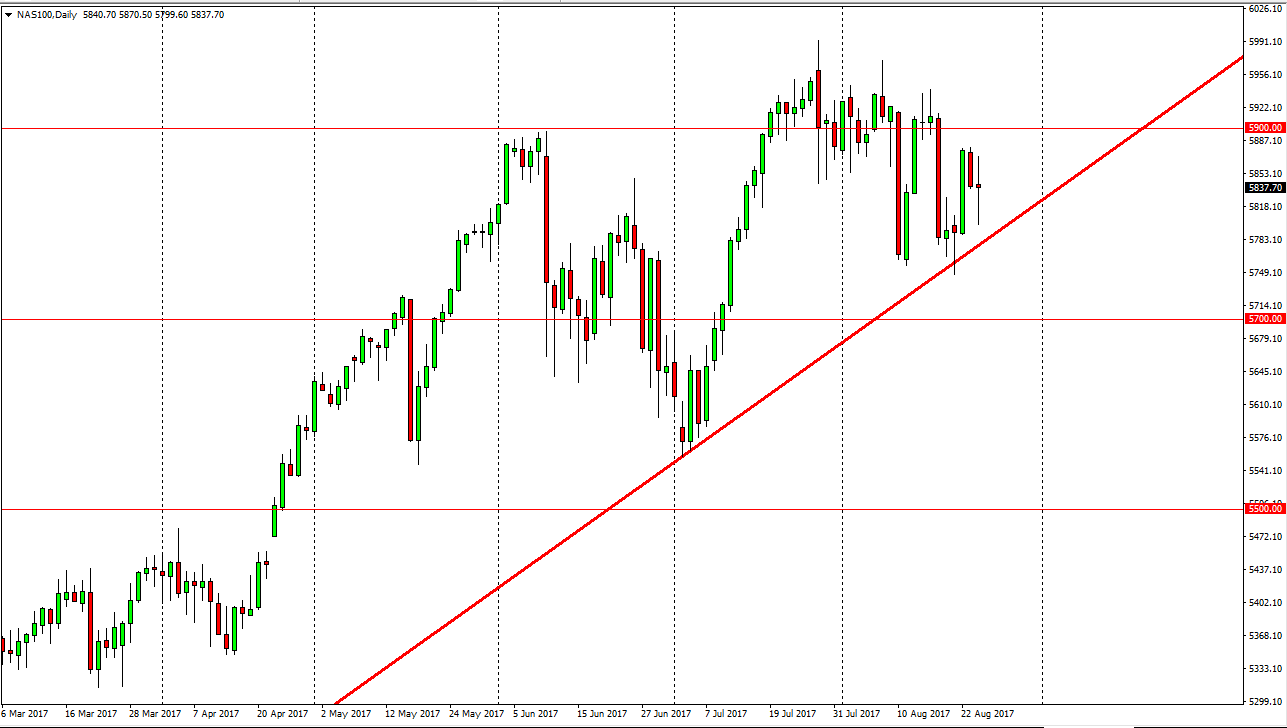

Nasdaq 100

The Nasdaq 100 went back and forth during the day as well, forming a relatively neutral candle. This index has been a leader for other US indices, and that should continue to be the case. Because of this, I believe that the market will eventually reach towards the 5900 level and that the uptrend line will of course be very important. I think that the market will continue to be very choppy, but given enough time the market should continue to find enough reason to go higher, not the least of which would be any good news out of Washington DC. If we break down below the uptrend line, the next support level would be somewhere near the 5700 level and a breakdown below there would be very negative. In the meantime, I think that the market will eventually try to get to the 6000 level, as it is a obvious target for large funds.

Leave A Comment