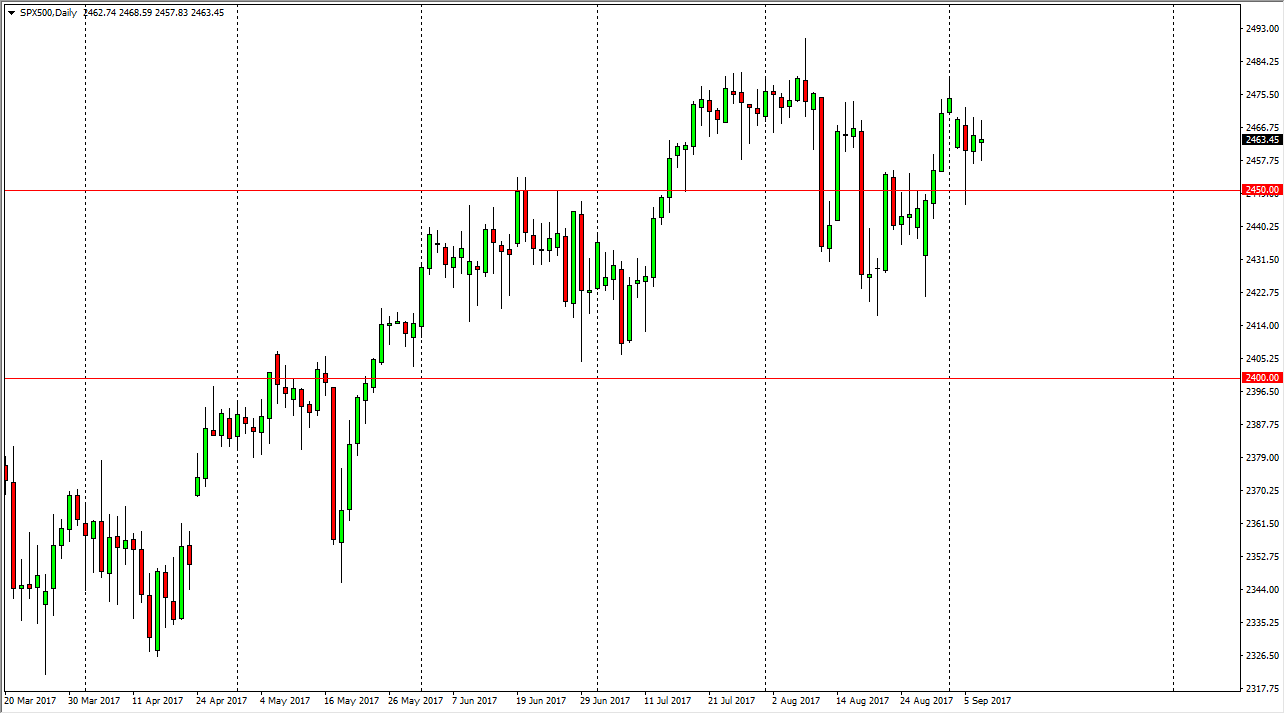

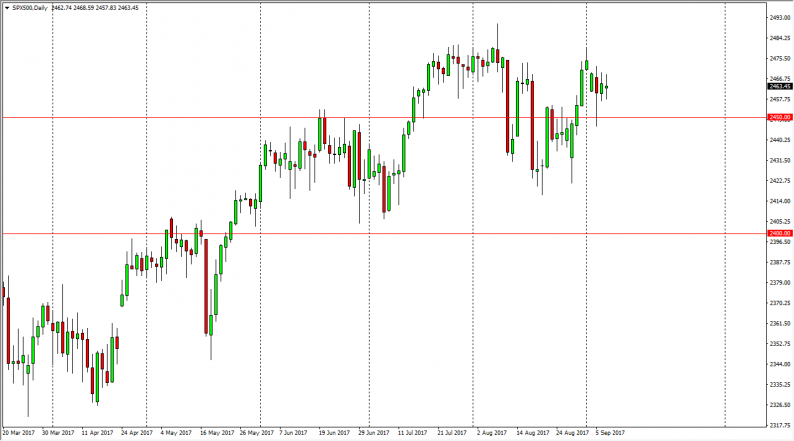

The S&P 500 went back and forth during the session on Thursday as we continue to grind overall. The 2450 level underneath continues to be supportive, and at this point, we are acting in reaction to the hammer from the Tuesday session. Ultimately, the market should go higher, perhaps trying to reach towards the 2500 level above. I believe the pullbacks continue to be buying opportunities, and that the 2450 level should continue to find plenty of attraction for traders. I also could make an argument for an uptrend line, so either way I think that eventually the buyers come in on dips as the algorithmic traders continue to look at these pullbacks as potential value. If we can break above the 2500 level, the market should continue to go much higher, as it would be the next leg in the longer-term uptrend.

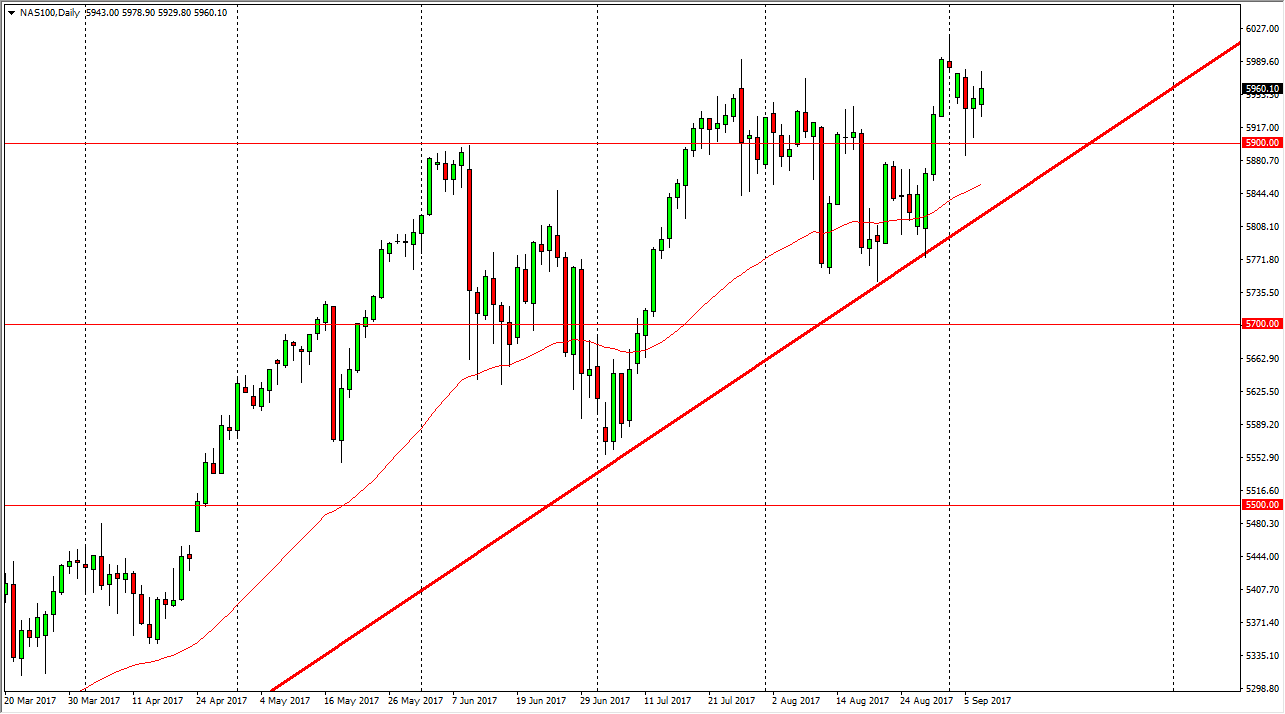

Nasdaq 100

The Nasdaq 100 went back and forth during the session, but did break above the top of the hammer from the Wednesday session, so that is a very bullish sign. The 6000 level above should be massive resistance, but if we can clear that area, we should continue to go much higher. I think that dips continue to be value the traders will take advantage of, as the uptrend line should continue to support this market in general. I also believe that the 5900-level underneath should be supportive due to the previous resistance that we saw that level. Given enough time, I think that the market should continue to go much higher, as it would be the next leg higher on the break out. If we break down below the uptrend line, then that would be a very negative sign. However, the Nasdaq 100 continues to be the leader in America, as we can see during the session on Thursday.

Leave A Comment