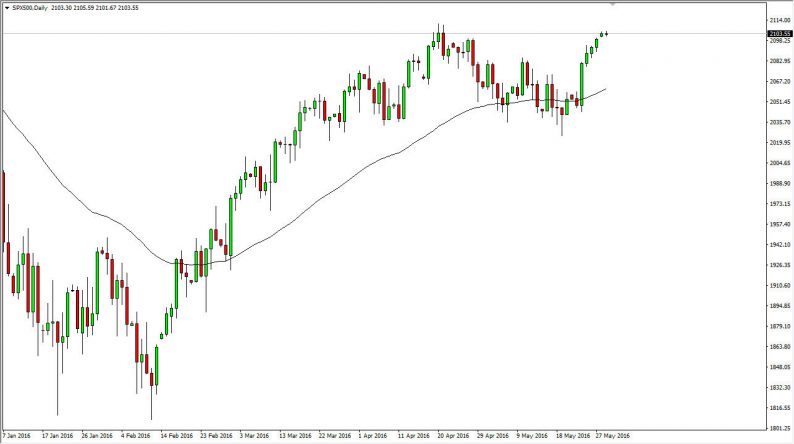

S&P 500

The S&P 500 of course was closed during the Monday session as it was the Memorial Day holiday in America, but the CFD markets gapped higher and as a result it looks as if the buyers are still very much in control of this market. I believe there will be buyers waiting just below and the market will continue to go higher. We have quite a bit of noise just below and of course we have the 50 day exponential moving average as well. Ultimately, this market should eventually clear the 2100 level and give us an opportunity to “buy-and-hold”, but in the meantime expect quite a bit of choppiness and of course volatility until we can build up the momentum to go higher.

Nasdaq 100

The Nasdaq 100 CFD of course gapped higher as well, but obviously the Nasdaq 100 was not trading. This is a market that’s trying to get towards the recent highs, and as a result we more than likely will see pullbacks in order to build up some type of enough momentum to finally break out to the upside. We would have to clear the 4600 level to go higher over the longer term, but in the meantime it’s very likely that pullbacks will have to deal with quite a bit of bullish pressure as seen by the recent impulsive candle.

As you can see on the chart, the 100 day exponential moving average is plodded on the chart, and it was previously resistance. It is because of this that I think any pullback to this moving average will more than likely find dynamic support that would be looked at as a value in a market that most certainly has quite a bit of bullish pressure. I have no interest whatsoever in selling this market, and as a result I believe that all we can do is buy.

Leave A Comment