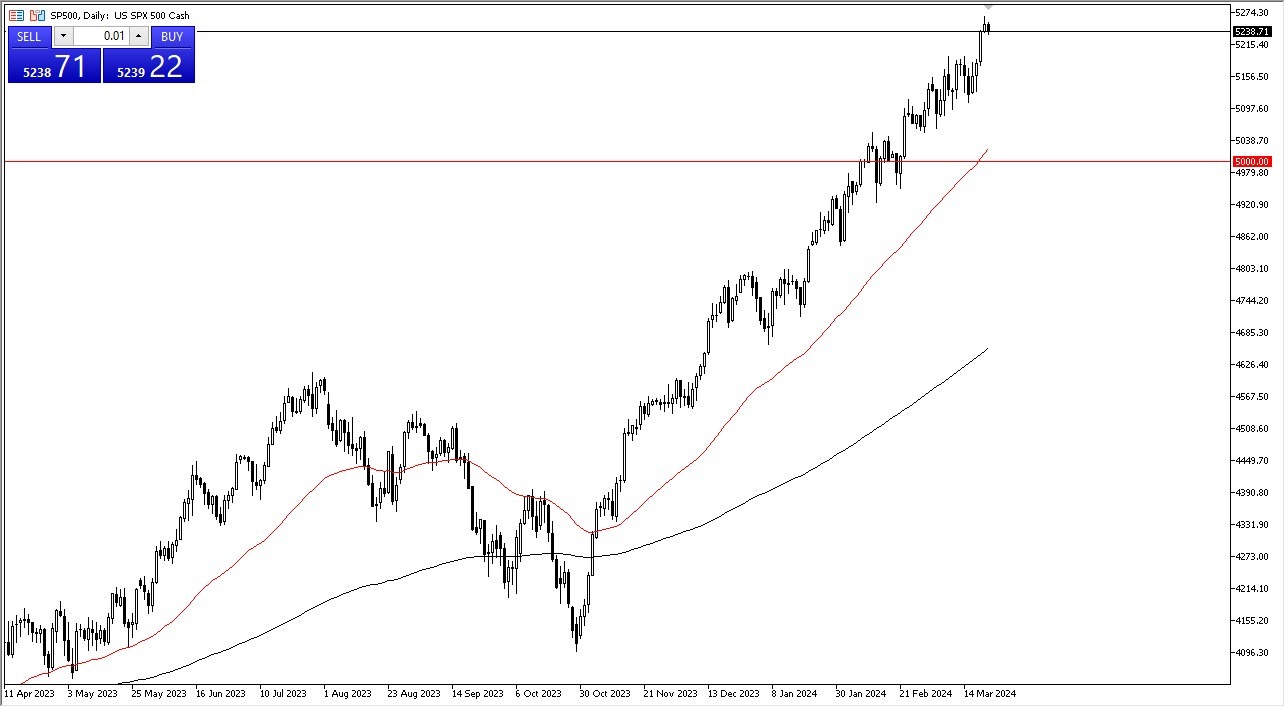

I have an interest in buying each dip and I think that the 5200 level would be an excellent entry point right along with the 5100 level.

I have an interest in buying each dip and I think that the 5200 level would be an excellent entry point right along with the 5100 level. Underneath there, we have the 5000 level, which is a large round psychologically important figure and an area that I think will obviously attract a lot of attention in and of itself as well. Buying Opportunities AboundBecause of this, I think you have to look at this through the prism of a market that will eventually offer plenty of buying opportunities. And at this point in time, it’s probably worth noting that the overall attitude of market participants are one that is based on FOMO trading. Eventually, I do think that we go much higher, but I also recognize that this is a market that you have to be somewhat cautious with because it is a little extended.  Over the longer term, I suspect that we have a situation where traders will continue to jump into the same handful of stocks that have been driving markets higher for some time as passive investing is such a huge part of institutional flows now. With that being the case, I think you have to understand that this is a market that has only one direction and that’s up. I think that you also have to be cautious of the idea of trying to get too big because we are a little extended, but clearly this is a one-way trade.More By This Author:CHF/JPY Forecast: Swiss Franc Showing Signs Of Support Against YenGold Forecast: Consolidation After Big MoveWeekly Forex Forecast – Sunday, March 24, 2024

Over the longer term, I suspect that we have a situation where traders will continue to jump into the same handful of stocks that have been driving markets higher for some time as passive investing is such a huge part of institutional flows now. With that being the case, I think you have to understand that this is a market that has only one direction and that’s up. I think that you also have to be cautious of the idea of trying to get too big because we are a little extended, but clearly this is a one-way trade.More By This Author:CHF/JPY Forecast: Swiss Franc Showing Signs Of Support Against YenGold Forecast: Consolidation After Big MoveWeekly Forex Forecast – Sunday, March 24, 2024

Leave A Comment