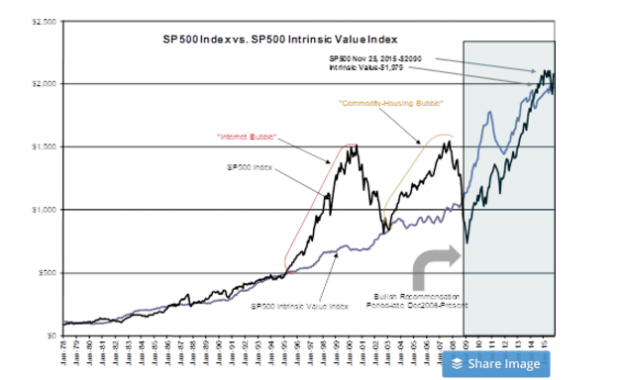

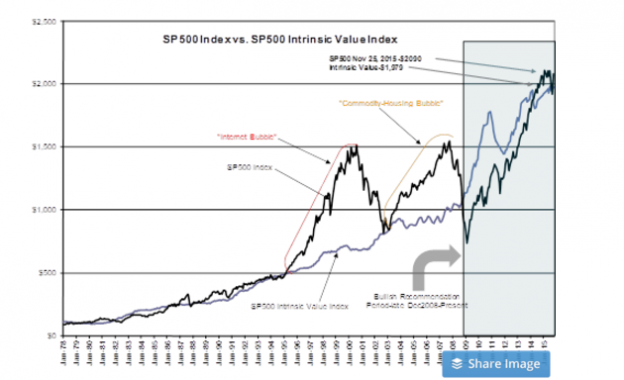

Market volatility has always been with us. But this market has been different since 1995 when Hedge Funds began to exert price dominance. Prices are set by the dominant market psychology. Since 1995 we have seen wide variations of the SP500 vs. SP500 Intrinsic Value Index ($SPY) which was designed to track the process Value Investors deploy in their thinking. Both of our recent market bubbles, the ‘Internet Bubble’ and the ‘Commodity-Housing Bubble’ also known as the ‘Sub-Prime Housing Bubble’ had significant deviations from the past relationship with the SP500 Intrinsic Value Index. These bubbles were due to Hedge Fund Momentum Investors.

Do you remember ‘Peak Oil’? ($OIL)($USO) Wikipedia has a good history of the thinking which fed market psychology in 2007. Net/net the often repeated belief was that the world was running out of oil and China would buy it all with its insatiable appetite. The US standard of living as we knew it was over! Did anyone notice that the concept of ‘Peak Oil’ has disappeared? There is a lesson to be learned here.

The Hedge Fund managers apply multiple approaches. The approach which has tended to overwhelm the others has been Momentum Investing. Momentum Investing is what it sounds like. Somewhat like the momentum concept in physics which is equal to mass times velocity (momentum = mass x velocity), investment market momentum is price times volume (investment momentum = share price x share trading volume). There are a number of Hedge Fund managers who do consider themselves ‘Rocket Scientists’. This investment approach is exercised by massive computer power and applied mathematical algorithms.

While many of these managers indicate that they are tracking economics and valuations, what they are really doing is tracking market psychology. If they see psychology causing prices to shift with an increase in trading volume, they jump into the trend with increasing amounts of capital. This drives the trend further in the direction the Momentum Investor identified. This continues gathering more and more capital till it stops. Then the Momentum Investor looks to find the next big trend. As Hedge Fund Momentum Investor capital builds, roughly ~$3 trillion today, they require larger and more liquid markets. They often need to switch direction quickly to capture a trend before another manager does this. Each manager is attempting to out-guess competitors, to get in first and out first. Market volatility has increased substantially as a result as seen by the change in SP500 vs. SP500 Intrinsic Value Index deviation post 1995 as compared to that pre-1995

Leave A Comment