A couple days ago it was noted that stocks are high risk, but also that I was more long than short. Yesterday we reviewed the still bearish state of the broad market. This bounce has tested my patience (vs. the preferred scenario seeing it as just a relief bounce) but this morning it looks like we may be getting somewhere. If pre-market holds up, here is what SPX is doing…

I am no longer net long after yesterday and still have a full short on SPY, which was increased last Friday during the obnoxious greed fest.

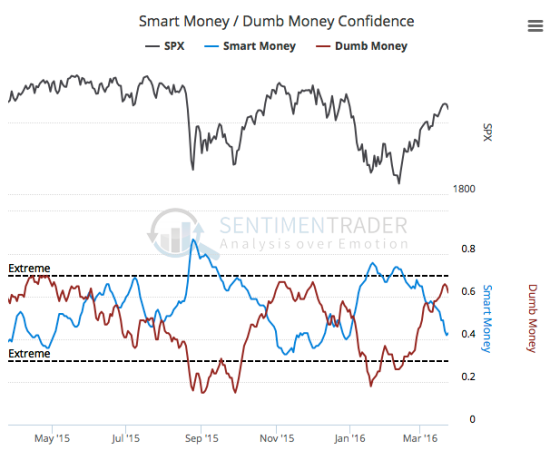

One thing that the market has going for it is that though sentiment is fully recovered (which was the job and definition of a relief bounce) the optimism (red line) and pessimism (green line) reacted pretty much in real time to the small down hitch yesterday. From Sentimentrader…

Dumb Money seems to be watching its trading screen with white knuckled intensity, just waiting for the downturn. Look at how the Dumb Money line apes the stock market. Then again, they weren’t so dumb at the bottom in February as they positively diverged SPX’s double bottom.

Regardless, sentiment has fully recovered and the stock market lives and dies by its technicals. Those would be bearish until proven otherwise.

Leave A Comment