US equities rallied today. Our benchmark S&P 500, which had slipped back into the correction zone (a 10% decline), opened higher and surged above that -10% stigma. By the noon hour it had given back over half its gains but then recovered to the vicinity of its opening rally shortly after the lunch hour. Some buying in the final 15 minutes took the index to its 1.83% closing gain just a few ticks from its intraday high.

The yield on the 10-year note closed at 2.20%, up 3 bps from yesterday’s close.

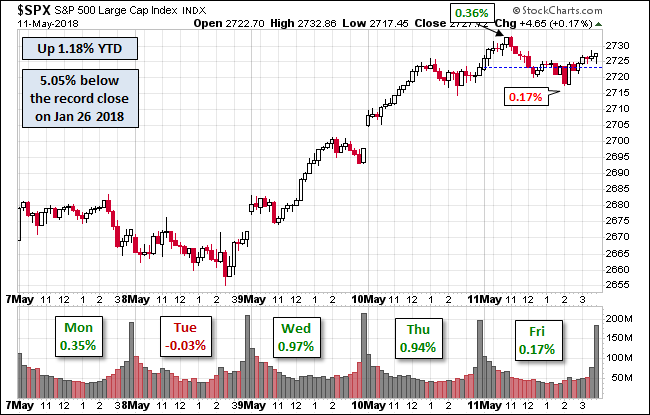

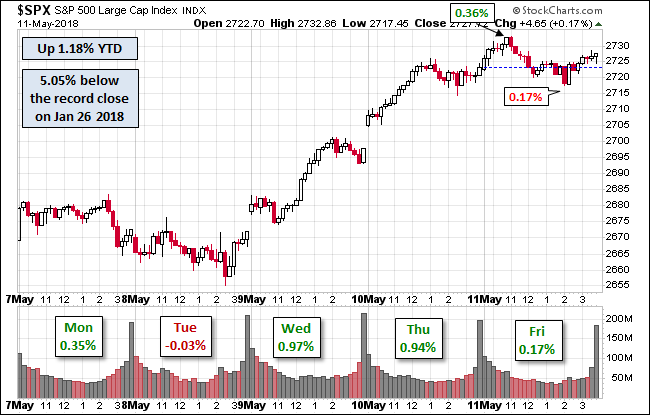

Here is a snapshot of past five sessions.

On a daily chart of the SPY ETF we see that volume on today’s gain was unremarkable and well below most of the levels during the recent selloff. It will be interesting to see if today’s advance triggers more participation tomorrow.

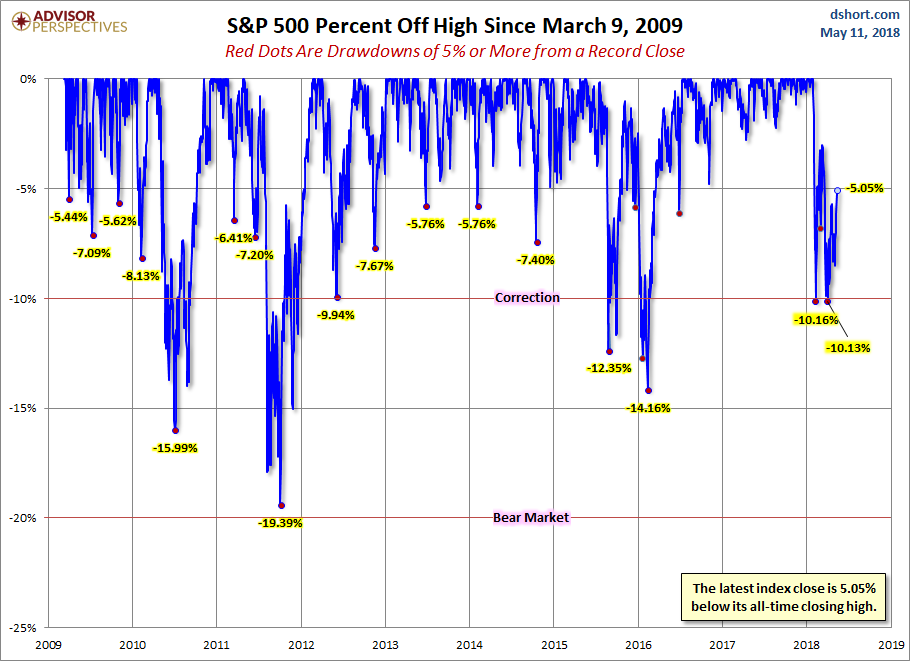

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

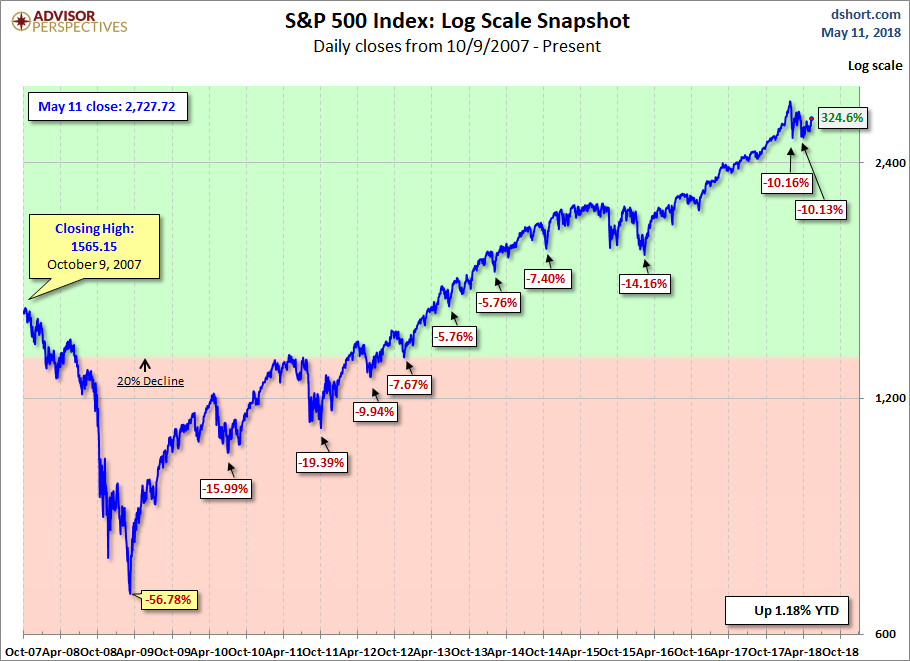

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Leave A Comment