The S&P 500 snapped a two-day advance with a modest -0.41% loss. The markets, of course, are focused on its sugar daddy, the Fed, and whether or not it will announce a rate hike Thursday afternoon.

The yield on the 10-year note closed the day at 2.18%, down two bps from the previous close.

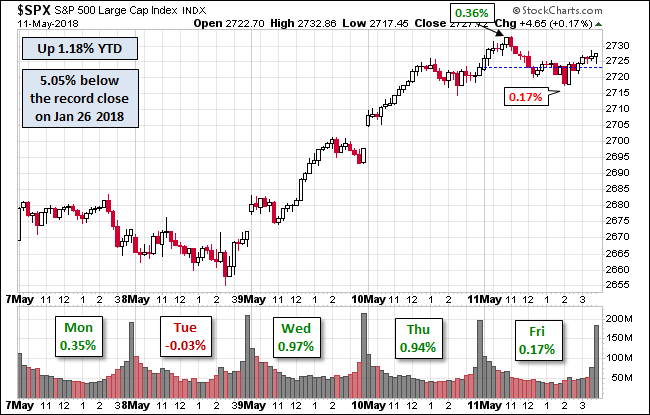

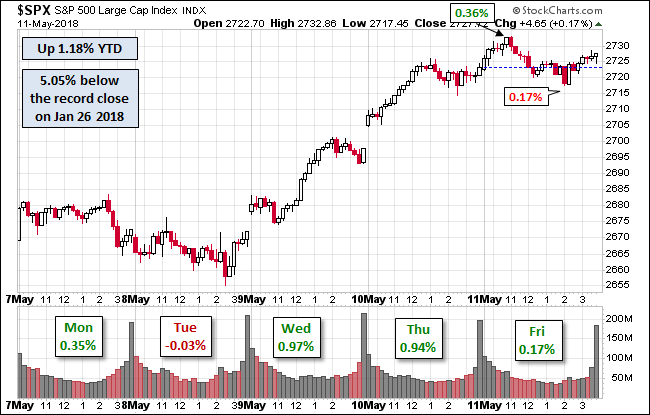

Here is a snapshot of past five sessions.

Today’s low trading volume, 25% off its 50-day moving average, underscores the fact that many investors are sitting on the sidelines in advance of the Fed decision.

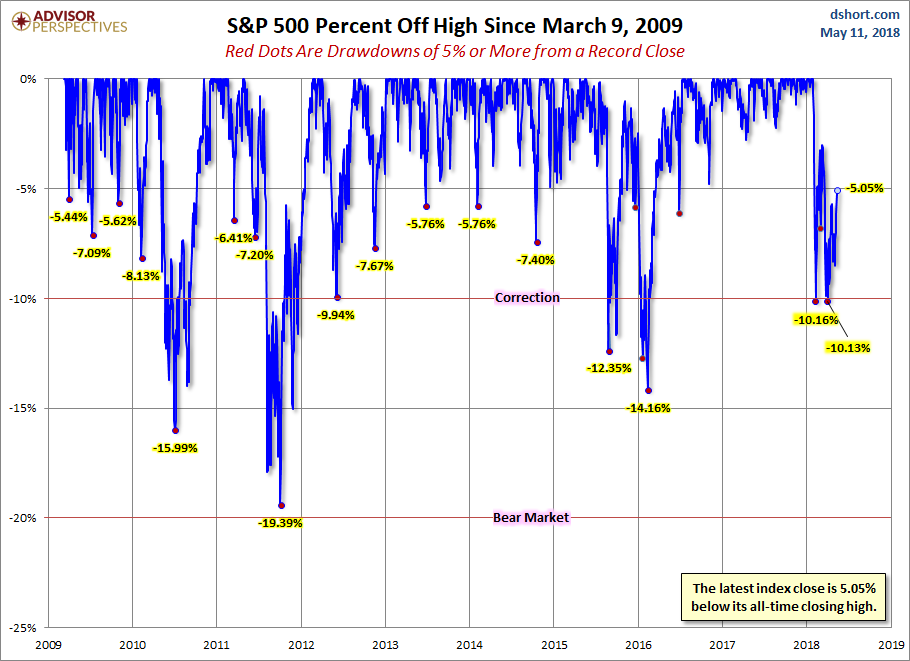

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Leave A Comment