News of successful police raids in France set the stage for a morning liftoff for US equity markets that was followed by an afternoon rally on the 2 PM release of Fed minutes paving the way for a December rate hike. The S&P 500 popped at the open and then drifted to a narrow lunch hour level at the vicinity of yesterday’s high. The index spiked higher on the Fed minutes and accelerated its gain to its 1.70% intraday high just before the bell. It closed with a 1.62% advance for the day. The index is now back in the green year-to-date, up 1.20% for 2015.

Treasuries reacted only modestly to the Fed minutes. The yield on the 10-year note closed at 2.27%, up only 2 bps from yesterday’s close.

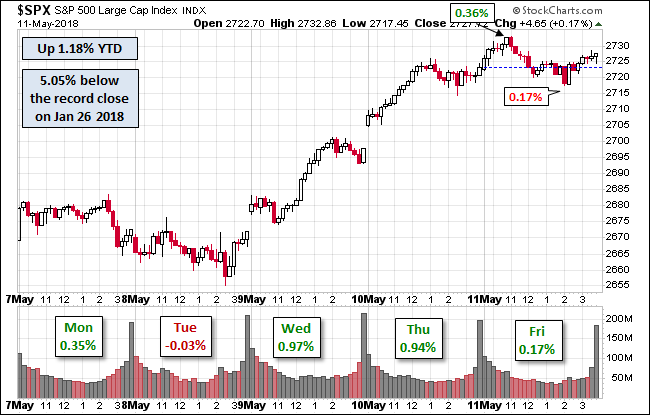

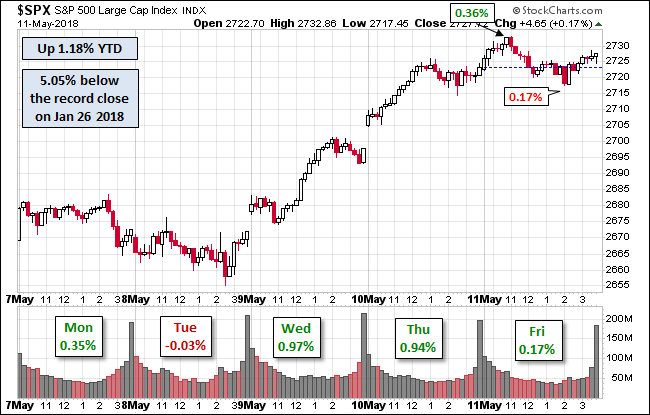

Here is a snapshot of past five sessions.

Here is a daily chart of the index. Trading volume for today’s rally was unremarkable. We see that the index closed the session above its 200-day price moving average.

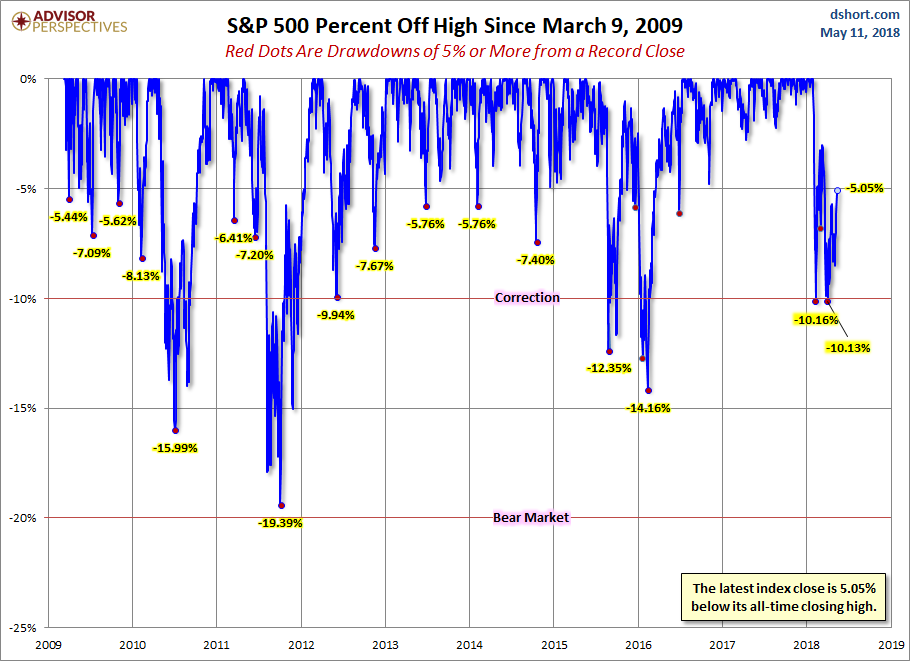

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.

Leave A Comment