On a day with no economic news, the S&P 500 hesitated at the open before rising to its 0.20% intraday high about 30 minutes into the session … an intraday record high, to be sure. The index then sold off to its -0.32% intraday low early in the lunch hour. It spent the afternoon in an extremely narrow trading range, drifting a bit higher during the final hour to its -0.11% close.

Here is a snapshot of the past five sessions.

The sell-off in treasuries continued today with the yield on the 10-year note closing at 2.49%, up two BPs from its previous close. The CBOE 10-year yield index intraday high was 2.51, the highest since September 30, 2014.

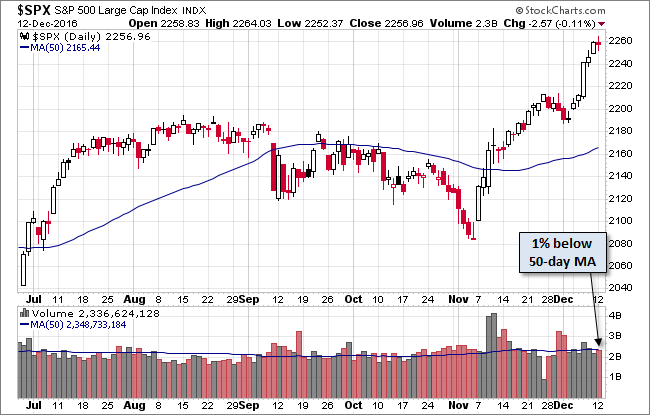

Here is a daily chart of the index. Trading volume on today’s fractional decline was unremarkable.

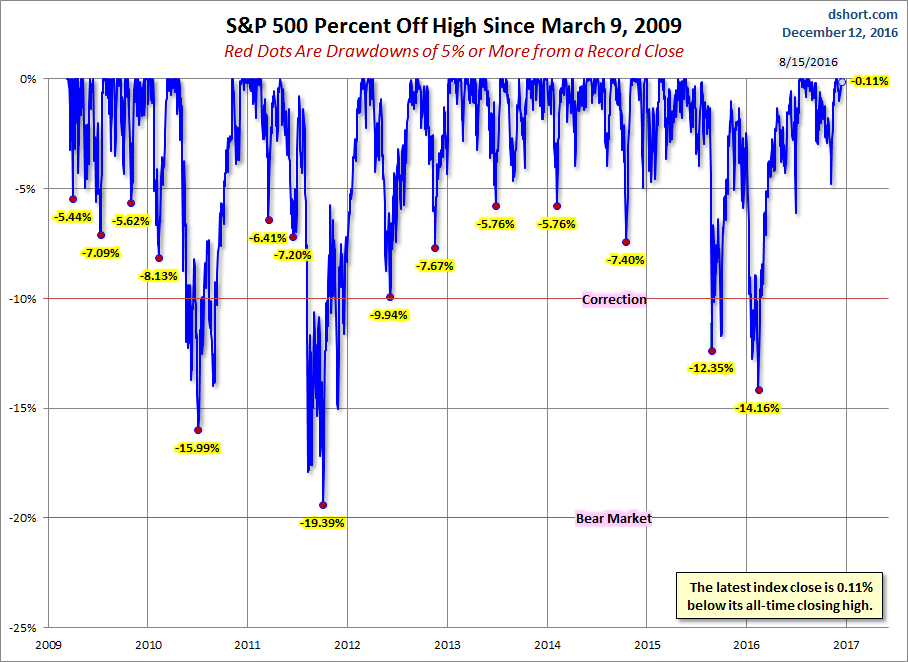

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

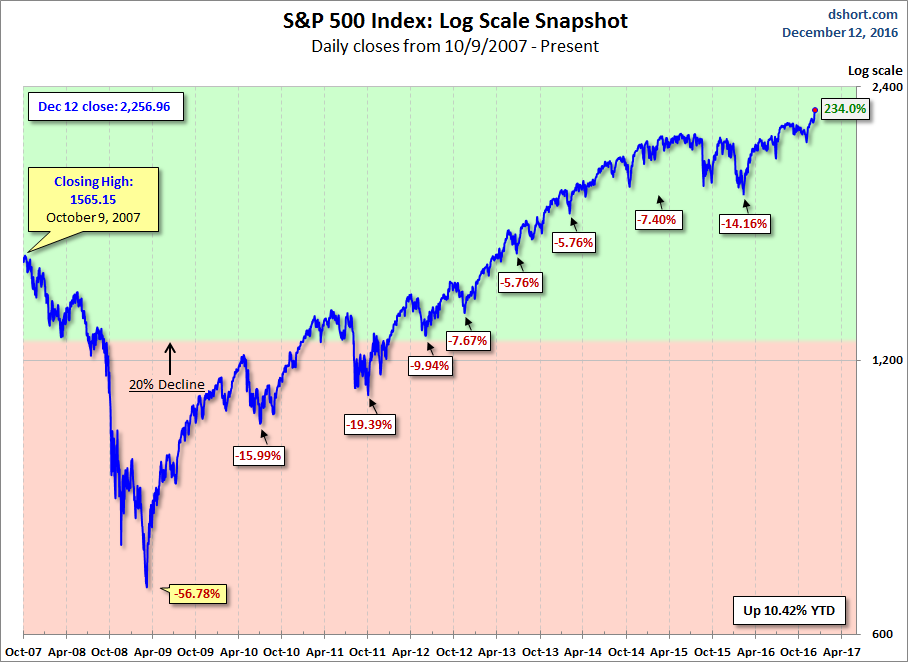

Here is a more conventional log-scale chart with drawdowns highlighted.

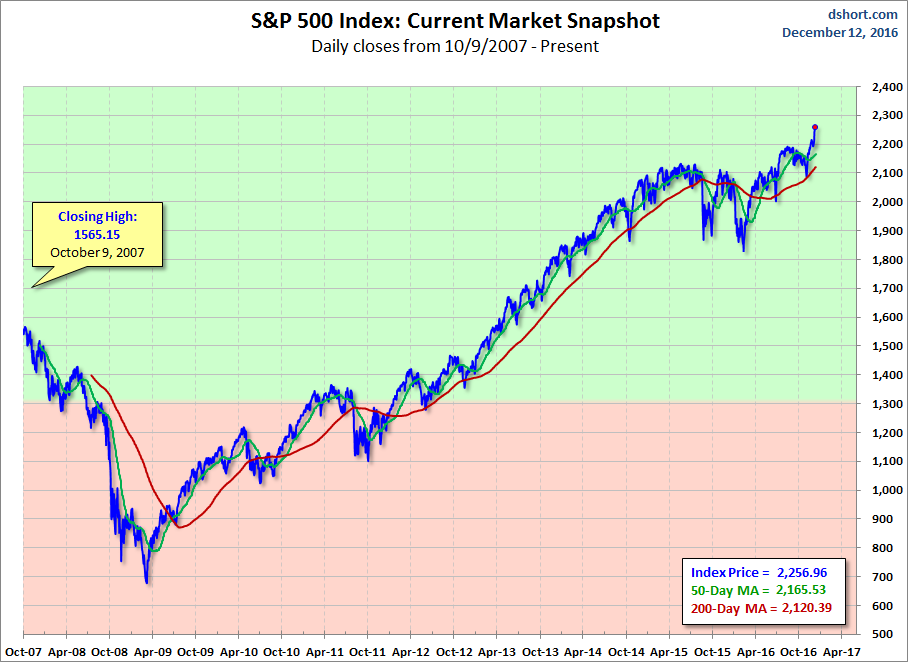

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

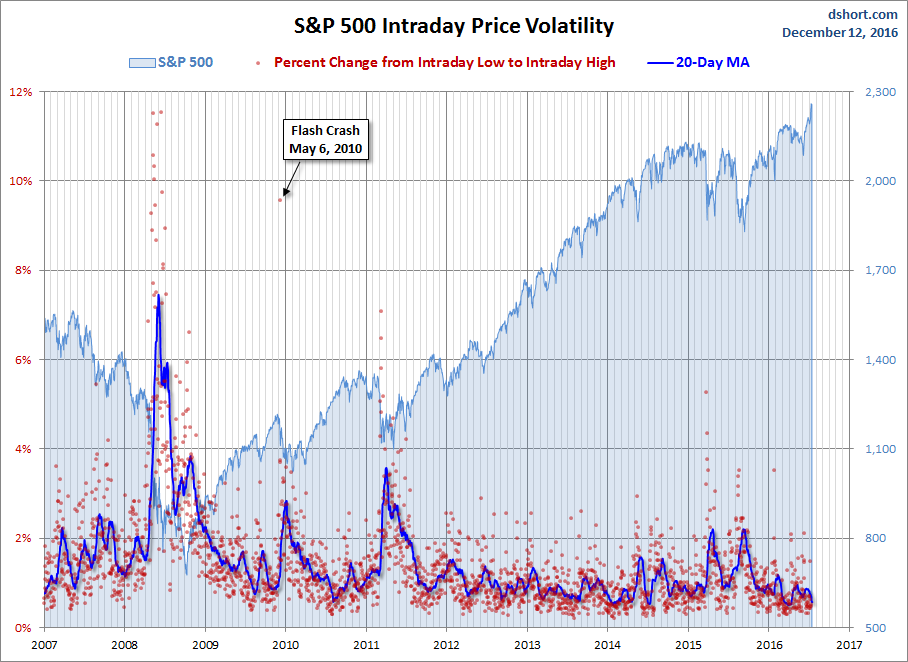

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.

Leave A Comment