It is fitting that just a few hours until the Fed’s second rate hike in two quarters, and one day after Goldman downgraded global stocks to Neutral for the next 3 months, not to mention with the results of the anticipated Dutch election due shortly, that global stocks as well as S&P futures are higher, while crude oil has finally managed to stage a rebound as the Dollar DXY index is fractionally in the red.

In addition to the Fed, a barrage of monetary policy decisions at the BOE, the BOJ, the SNB and Bank of Indonesia within the next 36 hours were further reasons for investors’ cautious stance.

East Coast traders return to their desks following a rather disappointing nor’easter, where they will be prompted bombarded by data over the next 2 days. Here is a quick summary of main events over the next 36 hours courtesy of Bloomberg:

Asian stocks have consolidated much of their recent gains on Wednesday before an FOMC meeting that braved yesterday’s non-blizzard and which is expected to signal not only another 25 bps interest rate increase but also how many more hikes traders can expect during the remainder of the year. Though recent data, particularly out of China, has fueled a rally in Asian equities since the start of the year, Reuters notes that investors are expecting more headwinds for emerging markets due to an increasingly hawkish Fed. “The positive sentiment towards emerging markets is not sustainable as the interest rate differential advantage in Asia’s favor is likely to reduce in the coming months,” said Frances Cheung, head of rates strategy for Asia ex-Japan at Societe Generale in Hong Kong.

Having posted its second-biggest daily gain this year in the previous session, MSCI’s index of Asia-Pacific shares ex-Japan was up 0.2% near the day’s highs in cautious trading. Asian had a good start to the week thanks to positive news out of China and India. Strong data out of China this week sparked a fresh rally in Hong Kong stocks while Indian shares climbed to a record high on Tuesday as investors regarded Prime Minister Narendra Modi’s landslide victory in the northern state of Uttar Pradesh as an endorsement for his economic reforms. While recent economic Chinese data has been supportive, Premier Li warned at a press conference that China’s economy faces domestic and external risks this year, but added the country has many policy tools to cope with them.

“China’s economy had pretty good performance in January and February. March data will be crucial as investors are anxious for any hint on whether the recovery is sustainable,” said Linus Yip, strategist at First Shanghai Securities Ltd.

Bucking the trend, Japan’s Nikkei was down 0.2% while stocks in mainland China and Korea were fractionally lower, by 0.08 and 0.04 percent respectively. Hong Kong shares pared declines as Chinese Premier Li Keqiang played down the risk of a trade conflict. Speaking at a press conference after the close of the annual National People’s Congress, Li said it’s important for both China and the U.S. to keep talking to build trust. Furthermore, a worrying drop in global oil prices has cast doubt on how much Asian policymakers are likely to raise interest rates this year to maintain their premium over U.S. rates, with risks of another global tantrum rising.

The S&P is set to open higher, with E-minis trading 0.2% in the green in early Tuesday trading.

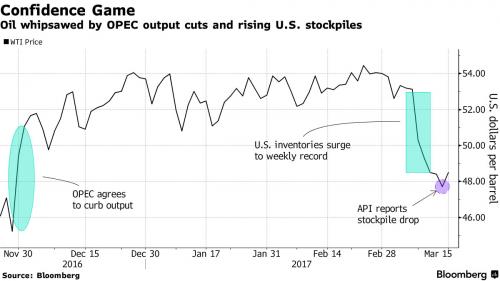

The big commodity story of the past week continues to be oil, and crude prices remain a dominant story in markets, with oil’s rebound helping underpin European stocks as investors wait for Wednesday’s expected U.S. interest rate increase. As Bloomberg notes, WTI trades above $48.50/bbl as Tuesday’s API drop in U.S. crude stockpiles counters Saudi boost in production reported by OPEC. IEA says market is still working to clear surge in output from end of last year.“The OPEC data sent us lower on the idea that there’s higher supply there, but we’ve flipped and now the APIs are suggesting inventories in the U.S. are ticking lower,” says Jasper Lawler, senior market analyst at London Capital Group. “The market is massively oversold and that’s been enough to trigger a bounce back.”

The swings in oil added some drama to financial markets that have entered a two-day period brimming with central bank decisions, European political drama and a raft of economic data. With the Federal Reserve seen as all but certain to raise rates, investors have been weighing how precarious energy prices will feed into the central bank’s path for future moves.

In currencies, the U.S. dollar was broadly unchanged against major rivals ahead of the FOMC meeting, and most attention will be focused on what Fed Chair Janet Yellen says about the future path of interest rates.The dollar index was flat at 101.69, staying in a well worn recent range. The British pound led gains in the Group-of-10 currencies, rising by as much as 0.9 percent before trading 0.4 percent higher. The euro rose by 0.2 percent to $1.0623, following its 0.5 percent drop a day earlier.

“Of course, everyone is waiting for the Fed, so we’re expecting range-bound trading until we get some clear signals about expectations for the rest of the year,” said Kaneo Ogino, director at foreign exchange research firm Global-info Co in Tokyo. Markets are also awaiting a meeting of the Group of 20 finance ministers and central bankers in the German town of Baden-Baden starting on Friday, their first meeting since Donald Trump won the U.S. presidential election.

Leave A Comment