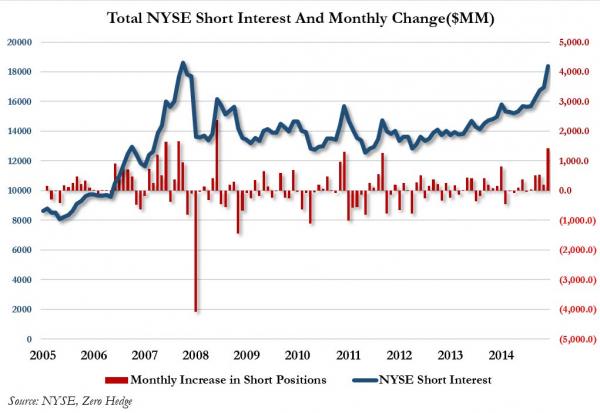

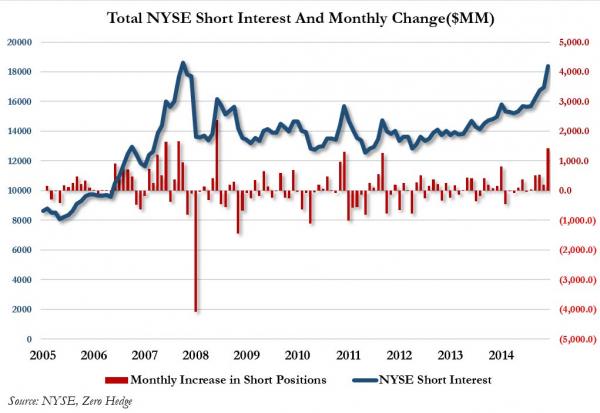

In the beginning of the month, when we showed that the NYSE short interest has risen to the highest level since July 2008, we said that this indicator either means that the market is poised for a crash as it did last time, or – more likely – would result in the biggest short squeeze in history.

We said that “either a central bank intervenes, or a massive forced buy-in event occurs, and unleashes the mother of all short squeezes, sending the S&P500 to new all time highs.”

Since then two things have happened: one after another central bank did intervene, leading to the biggest VIX monthly drop in history…

… and yes, as Bank of America said, “It’s Not A Risk-On Rally, This Is The Biggest Short Squeeze In Years.”

So, where does that leave us?

While we still haven’t taken out the all time highs said squeeze would lead to – there are about 30 points to go there; but as the following chart below shows, with just two trading days left, October is on pace for the biggest monthly point jump in S&P500 history.

… which courtesy of the earnings recession in the past two quarters, has pushed the market right beyond the point where back in May Janet Yellen said “valuations are quite high.”

Leave A Comment