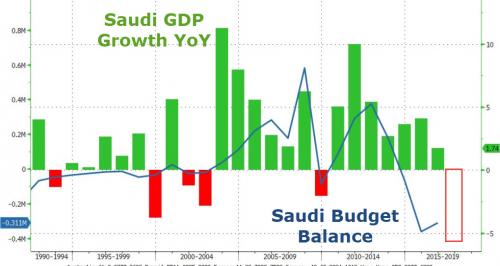

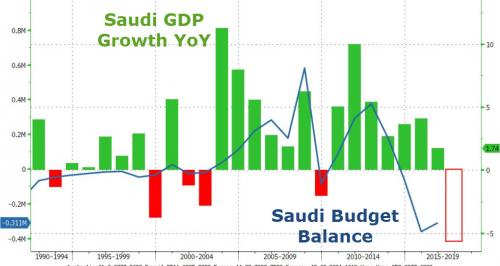

Back when oil was at $100 and above, the Saudi economy was firing on all cylinders, and nobody even dreamed that the crown jewel of Saudi Arabia – Aramaco – would be on the IPO block in just a few years. However, with oil stuck firmly in the $50 range, things for the Saudi economy are going from bad to worse, and today Riyadh – when it wasn’t busy preventing Yemeni ballistic missiles from hitting the royal palace – said its economy contracted for the first time in eight years as a result of austerity measures and the stagnant price of oil, as the Kingdom announced record spending to stimulate growth.

OPEC’s biggest oil producer said 2017 GDP shrank 0.5% due to a drop in crude production, as part of the 2016 Vienna production cut agreement, but mostly due to lower oil prices. The last time the Saudi economy contracted was in 2009, when GDP fell 2.1% after the global financial crisis sent oil prices crashing. Riyadh also posted a higher-than-expected budget deficit in 2017 and forecast another shortfall next year for the fifth year in a row due to the drop in oil revenues: the finance ministry said it estimates a budget deficit of $52 billion for 2018.

More surprising was the Saudis announcement of a radically expansionary budget for 2018, projecting the highest spending ever despite low oil prices in a bid to stimulate the sluggish economic, saying it expects the GDP to grow by 2.7%. While we wish Riyadh good luck with that, we now know why confiscating the wealth of ultra wealthy Saudi royals was a key component of the country’s economic plan…

Specifically, spending is at 978 billion riyals ($260.8 billion), up 10% on 2017 estimates, the Saudi finance ministry said: “The 2018 expansionary budget includes a number of new development projects,” Crown Prince Mohammed bin Salman, who oversees the economic affairs, said in a statement quoted by the official Saudi Press Agency. It was unclear if the projects include the prince purchasing another ultra expensive French chateau or just a few more Leonardo paintings purchased by proxy.

Leave A Comment