The ‘buy-the-pullback’ of yesterday was thrown into a bit of doubt as sellers made some early inroads into those gains.

The bullish ‘hammer’ in the S&P which had marked support at the 200-day MA for a second day is under some pressure. It comes on the back of a ‘sell’ trigger in the MACD and a decisive ‘sell’ trigger in On-Balance-Volume. Substantial gains banked from September are under threat from profit takers. The question is whether buyers can come back and swing this back to accumulation than current distribution.

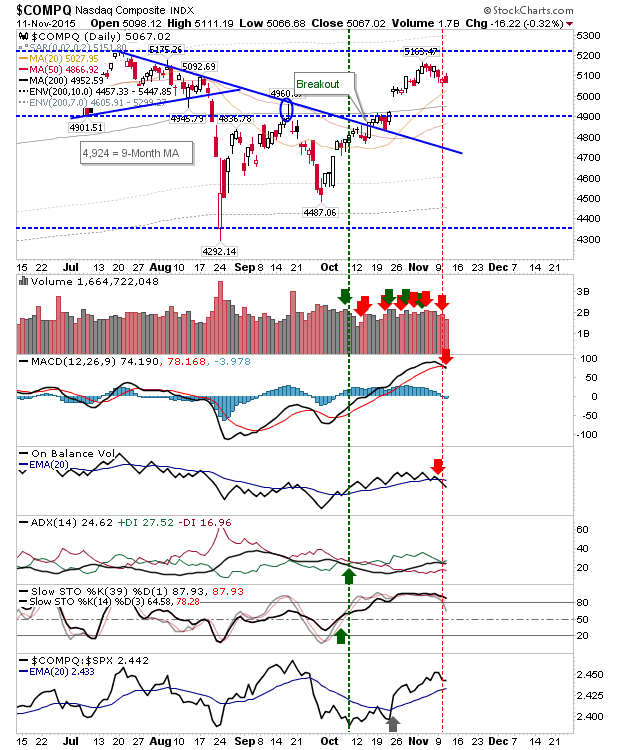

The Nasdaq also is working on ‘sell’ triggers in MACD and On-Balance-Volume. Unlike the S&P it hasn’t the 200-day MA to lean on (this is still some distance away), but does have a fast approaching 20-day MA to work with. The index is caught in a no-mans-land, so even if sellers did make an appearance tomorrow it wouldn’t be too damaging. The index is outperforming the S&P, which will keep buyers interested.

The index which may offer more to shorts is the Nasdaq 100. Here is an index which is in the process of confirming a ‘bull trap’. Technically, it’s not as weak as the Nasdaq or S&P, but a failure to return above 4,700 keeps it under the watchful gaze of bears.

The Russell 2000 finished at the lows. It has the 20-day MA to lean on, with an upcoming bullish cross between 50-day and 200-day MAs. This is a slow burner for bulls and may prove to be more resilient as profit taking sweeps other indices. Note, it hasn’t triggered a MACD ‘sell’.

For tomorrow, bulls can keep an eye on the Russell 2000 and perhaps the S&P. The former has the most to gain with long standing under-performane to overcome. Bears can keep an eye on the Nasdaq 100 and see how the ‘bull trap’ evolves.

Leave A Comment