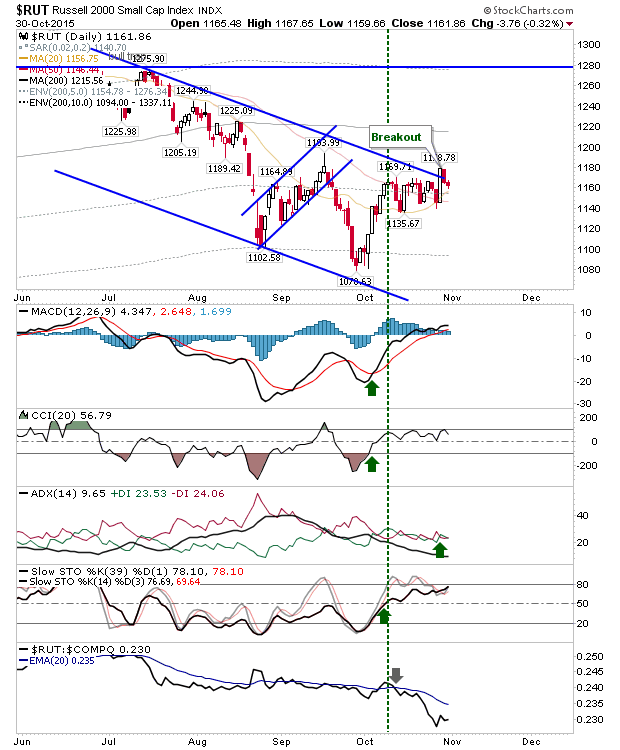

Thursday saw Small Caps take a bit more of a beating than other indices, and Friday was an opportunity for other indices to catch up. The previously hit Russell 2000 didn’t suffer too much additional damage, so Monday may offer bulls the chance to make a fresh run on all lead indices.

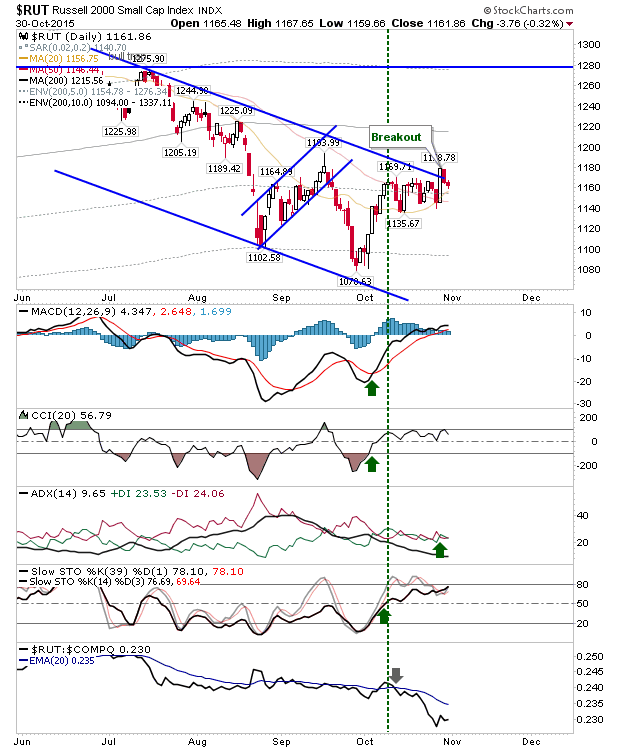

The Russell 2000 is showing a weakening of trend with the ADX below 10 and plenty of whipsaw between +DI and -DI. This probably helps bulls more as the index looks to break from the declining trend.

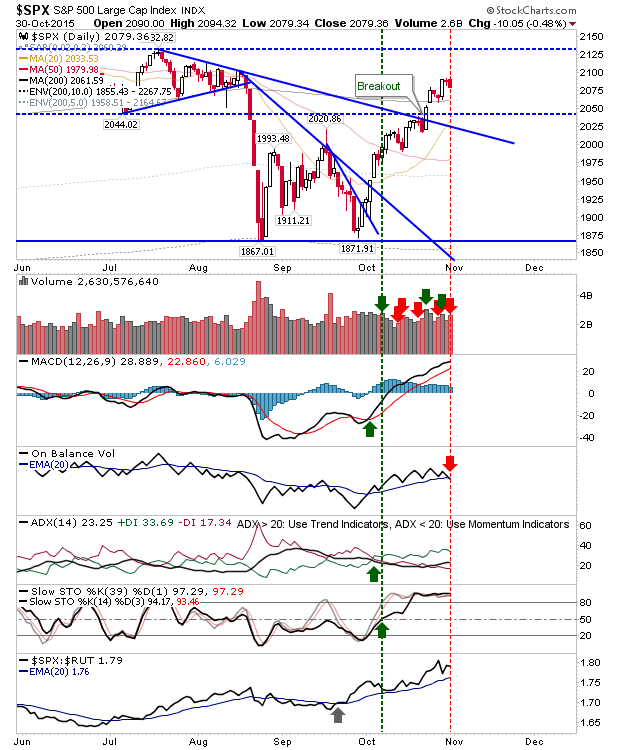

The S&P took a small loss. The 200-day MA is looking key here. Each day above this moving average strengthens it as support. The tick in the bear column is the bearish cross in On-Balance-Volume. If sellers maintain control on Monday it will expand on the distribution and threaten an undercut of the 200-day MA.

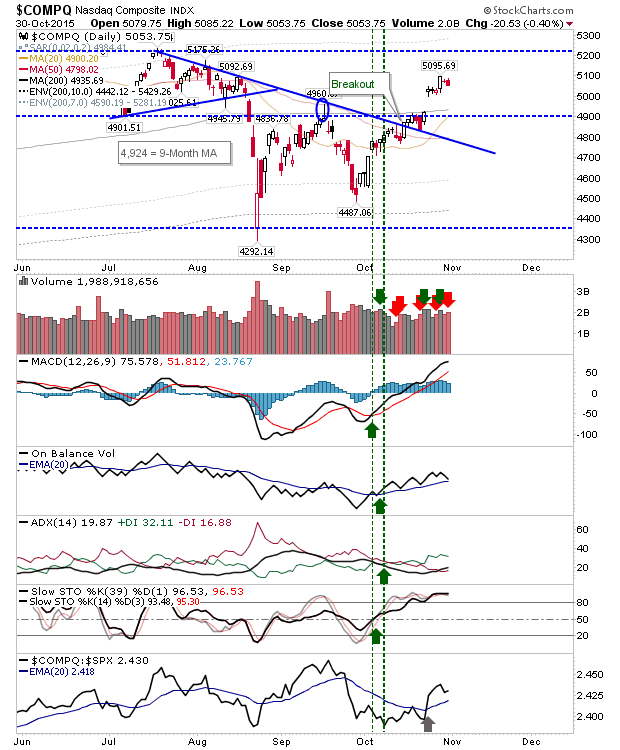

The Nasdaq (QQQ) suffered the narrowest loss, and given its position between 200-day MA support and 2015 high resistance it was a bit of a non-event. No advantage for either side here.

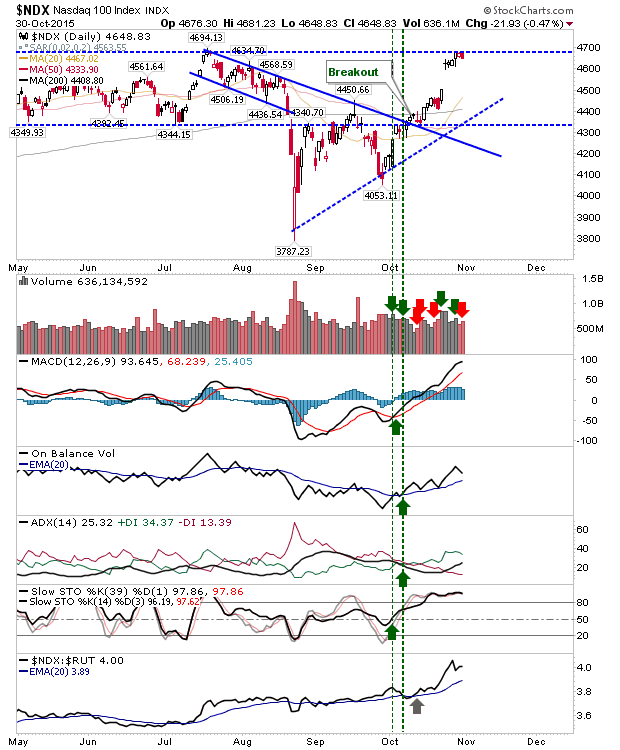

The Nasdaq 100 was trading at resistance, so Friday’s loss is playing as a profit taking and a chance for shorts to squeeze longs. I have taken a speculative short-side play on this, Stops are tight.

For Monday, bulls can look to the S&P and whether it can hold on to its 200-day MA. Shorts can track the Nasdaq 100 and watch for an expansion to the downside..

Leave A Comment