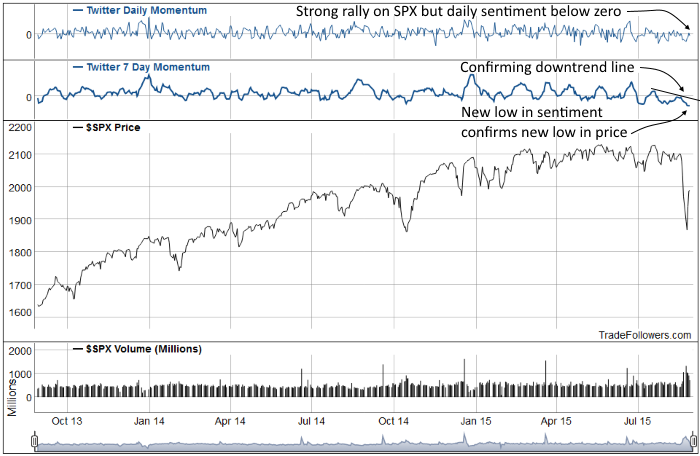

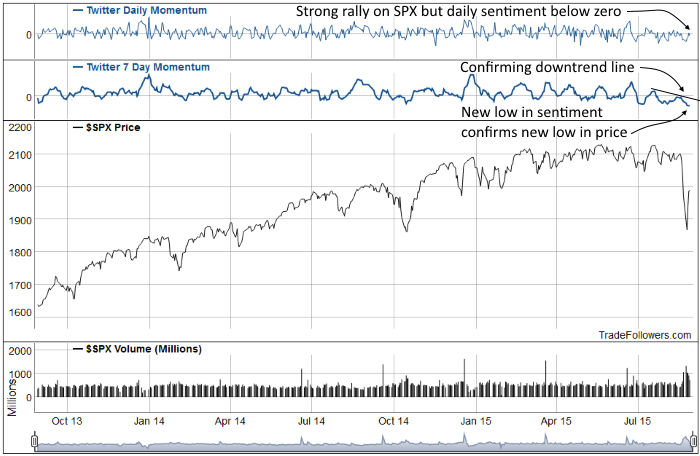

Over the past several weeks I’ve been chronicling the change in sentiment on the Twitter stream as it lead the market lower. In early July sentiment turned from bullish to neutral. By the end of the month sentiment had clearly turned bearish evidenced by both momentum and the rise in the number of bearish stocks. As the market traded sideways in early August sentiment continued to show mostly bearish readings then made an attempt to rise back above zero. That attempt failed and we watched the S&P 500 Index (SPX) fall hard as market participants panicked.

The extreme fear and oversold readings in 7 day momentum last week created the conditions necessary for a good size bounce. Now what? Unfortunately, it appears that the volatility last week created a large amount of damage to investor sentiment. The rally out of Tuesday’s lows had little positive effect on daily sentiment. It had trouble getting above zero. This is causing 7 day momentum to continue to confirm a downtrend in price for SPX. 7 day momentum also printed its third oversold reading since the first of July. The latest print created a new low which is confirming the low in price on SPX. These aren’t the conditions I’d like to see after a strong rally and indicate that market participants will likely sell further strength.

Resistance levels gleaned from trader’s tweets suggest that the most likely areas of profit taking (or relief rally selling) will be near 2000, 2040, and 2100 on SPX (if it can make it that far amid the selling). The drop last week created a lot of fear for lower prices. The range below 1865 has a significant number of tweets stretching all the way to 1700, with scattered tweets calling for prices to fall as low as the 1400 to 1425 area on SPX. The wide range between support and resistance suggests that traders (and likely investors) will chase price rather than make committed allocations to the market. As a result, I expect volatility, both up and down, to continue in the near future with support at 1865, 1820, and 1800.

Leave A Comment