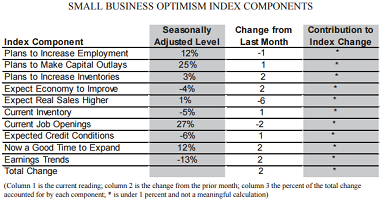

The National Federation of Independent Business’s (NFIB) optimism index improved 0.2 to 96.1 – and still not above the 42 year average of 98.. The market was expecting the index between 94.8 to 96.5 with consensus at 95.8.

NFIB chief economist Bill Dunkelberg states:

Small business optimism continues to be stagnant, which is consistent with the expected economic growth of about 2.5 percent. The percent of owners citing the difficulty of finding qualified workers as their Single Most Important Problem increased and is now third on the list behind taxes and regulations. This is the highest reading since 2007 and suggests that employers will continue to face wage pressure in order to attract and keep good employees.

Report Commentary:

The Federal Reserve decided that doing nothing was the best thing for jobs – or for “global concerns” or to make LeGarde and the World Bank happy along with all of the equity traders even though the evidence suggests that the Fed can’t impact employment significantly. None-the-less, Chairman Yellen put “jobs” at the top of her policy priority list. Meanwhile, banks can only lend to the best borrowers at the Fed’s low rate structure, believing that the cost of funds will rise and squeeze out profitability before rates can be reset. Savers aren’t interested in lending their money (depositing at banks, etc.) at these low rates. Trillions of dollars of low yield Treasury securities issued over the past 7 years guarantee sub-par returns to savers and investors for the next decade. Interest income is billions below what “normal” rates would deliver and the Fed continues to hoard trillions of dollars in riskless securities that the market would love to have. Cheap money induces investors to make investments that wouldn’t pass muster in a normal economy. Not a helpful set of outcomes.

Owners make it clear that credit availability and costs are not holding them back. Indeed, another NFIB survey shows that 41 percent are significantly distressed about Fed indecisiveness and another 34 percent are “somewhat” concerned.

Consumer sentiment (University of Michigan) fell in September. Nearly 60 percent reported hearing unfavorable news about the economy. Far more consumers think government policy is “poor” than think it is “good” (20 percent vs 44 percent). Over 20 percent of owners who think it is a bad time to expand blame “political uncertainty. Uncertainty is the enemy of economic growth.

Growth has displayed a “herky jerky” pattern, GDP from 0.6 to 3.9 percent, jobs from 245,000 down to 143,000, stocks gyrating as gamblers adjust their bets. In the meantime, economic policy is in disarray, including the Fed’s. What a mess. Only the strongest private sector can continue to produce growth in this environment. If we are growing at a 4 percent rate (second quarter), the strength isn’t coming from the small business sector.

Leave A Comment