Market Analysis

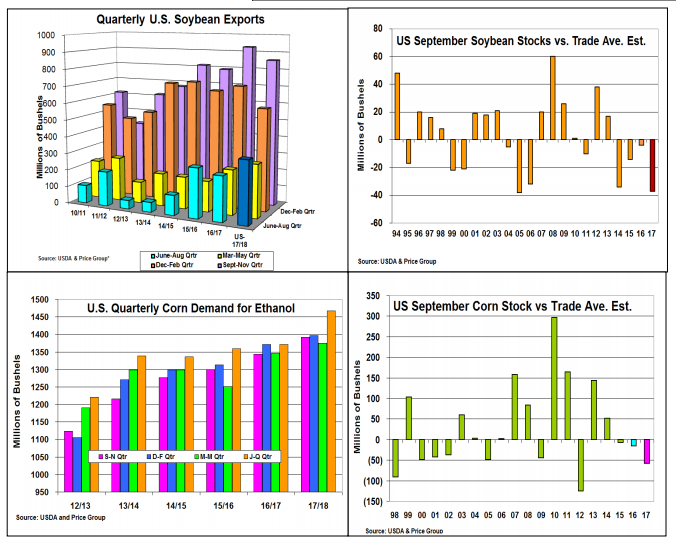

Traditionally, September’s grain stock reports were non events. These reports generally confirmed the USDA’s and trade’s corn and soybeans old-crop ending stocks expectations that were posted earlier that month. However, this began changing in the late 2000s with crop quality, crop size and crop development impacting these final stocks vs. the trade ideas. However, after the USDA’s numerous 2017/18 demand changes earlier this month, next Friday’s ending stocks adjustments look to be very modest this year. Only, a sizable soybean crop size decline or a big change in corn’s feed demand could shrift these ending stock levels dramatically.

Earlier this month, the USDA upped its overseas bean demand by 20 million bu. capturing much of this past summer’s stronger shipments with its 2.130 billion bu. update. NOPA’s recent August crush was 4 million less than the trade’s average, but this level seems to fit the USDA’s 2.055 billion bu. yearly forecast, which was upped 15 million earlier this month. Interestingly, soybean stocks have been below expectations by 5-35 million bu. the past 4 years. This suggests the 2017/18 US bean crop could 15-20 million bu. smaller and the latest Sept 1 US bean stocks could be 385 million bu.

Similarly, the USDA’s 25 million bu. increase in corn’s export outlook on the September US supply/demand report covered this foreign demand change. 2018’s record breaking US ethanol output pace continued during August advancing this demand by 17-20 million bu. Despite strong livestock and poultry numbers and feedlot inventories this past year not advancing corn’s direct feed demand because of larger US supplies of DDGs and sorghum from previous Chinese export conflicts, higher domestic wheat prices likely kept corn in most feed rations this past summer. This suggests a slightly smaller 1.988 billion US corn ending stocks.

What’s Ahead

Leave A Comment