Based in Roswell, Georgia, SiteOne Landscape Supply Inc. (NYSE: SITE) has filed for an IPO, set for this Thursday, 5.12, with a proposed maximum offering price of $100 million. The company distributes landscape supplies through its subsidiaries in the United States and Canada.

We previewed the IPO last week for those looking for an early glimpse.

SiteOne Landscape Supply will offer 10 million shares at an expected price range of $20 to $22.

SITE filed for the IPO on August 18, 2015.

Lead Underwriters: Deutsche Bank Securities, Goldman Sachs, and UBS Investment Bank

Underwriters: Academy Securities, Barclays Capital, HSBC Securities, ING Financial Markets, Natixis Securities, RBC Capital Markets, Robert W. Baird & Co., SMBC Nikko Securities America, SunTrust Robinson Humphrey, and William Blair & Co.

Business Summary: Distributor of Landscape Supplies in the U.S. and Canada

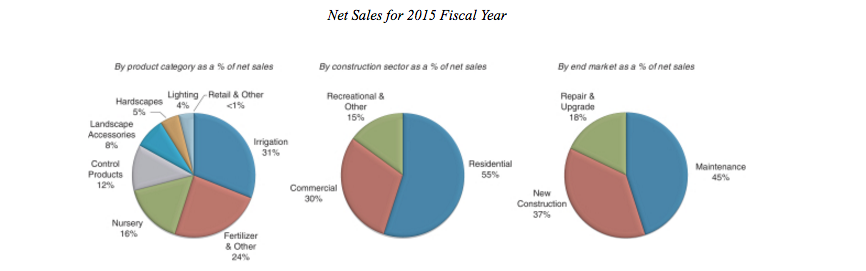

As described in company SEC filings, SiteOne Landscape Supply distributes landscaping supplies and materials through its subsidiaries in the United States and Canada. Its products include landscape accessories, irrigation supplies, herbicides, fertilizer and control products, turf protection products, turf care equipment, grass seed and golf course maintenance supplies. In addition, the company provides nursery goods and hardscapes including natural stones, pavers, and blocks, ice melt products and outdoor lighting.

(Source)

SiteOne Landscape Supply also offers landscape consultation services to its clients. The company markets its products to residential customers and commercial landscape professionals. In particular, these customers specialize in the design, installation, and maintenance of lawns, golf courses, gardens and other outdoor spaces.

SiteOne Landscape Supply is the largest and only national wholesale distributor of such products and materials in the United States. Their North American network includes 477 branch locations in 44 states and five Canadian provinces. Their product portfolio has over 100,000 stock keeping units, and the company estimates that it is approximately four times the size of its largest competitor.

Leave A Comment