Shake Shack Inc. (SHAK – Free Report) reported better-than-expected fourth-quarter 2017 results.

Adjusted earnings of 10 cents per share beat the Zacks Consensus Estimate by 5 cents. Also, the bottom line rose 11.1% year over year given an increase in revenues.

Revenues surged 31.2% year over year to $96.1 million and outpaced the consensus mark of $3 million. Rise in Shack sales and licensing revenues drove this top-line improvement.

Despite the earnings beat, slow comps growth in the quarter and a comps decline for 2017 probably have made investors apprehensive about Shake Shack’s growth in the near term, resulting in a 4.6% share price fall in after-hours trading.

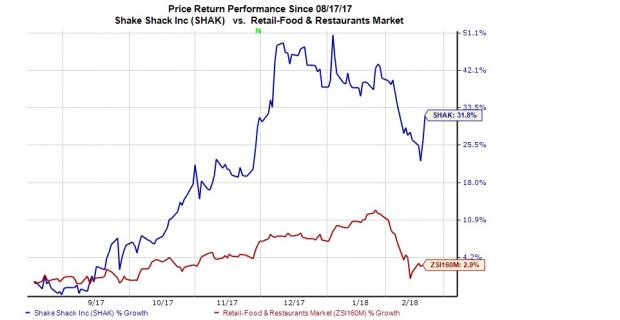

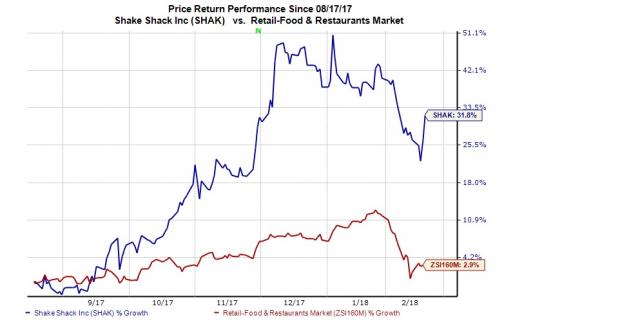

However, in the last six months, Shake Shack stock has rallied 31.8%, significantly outperforming the industry’s 2.8% growth.

The Top Line in Detail

Shack sales improved 31.3% year over year to $93.1 million, primarily owing to the opening of 26 new domestic company-operated Shacks. Shake Shack’s cult following and successful expansion into various cities around the world boosted Shack sales as well as traffic.

Licensing revenues for the quarter under review came in at $3 million, up 27.9% year over year on the back of unveiling 19 net new licensed Shacks. The company continues to cash in on the diversification of its licensing business and the opportunity to reach places that it could not, domestically.

Same-Shack sales (or comps) inched up 0.8% year over year. The figure compared unfavorably with the year-ago quarter’s 1.5% rise. The metric declined 1.6% last quarter. For the reported period, comparable SHAK base that includes restaurants open for 24 full fiscal months or longer, had 43 Shacks compared with 29 in the year-ago quarter.

Shake Shack, Inc. Revenue (TTM)

Shake Shack, Inc. Revenue (TTM) | Shake Shack, Inc. Quote

Operating Performance

Shack-level operating profit (non-GAAP operating income) of $23.5 million was up 30.3% year over year. The metric margins as a percentage of Shack sales decreased 20 bps to 25.2%, primarily due to increased labor and related expenses, certain fixed expenses and a rise in facility costs plus introduction of a broader range of unit volume Shacks.

Leave A Comment