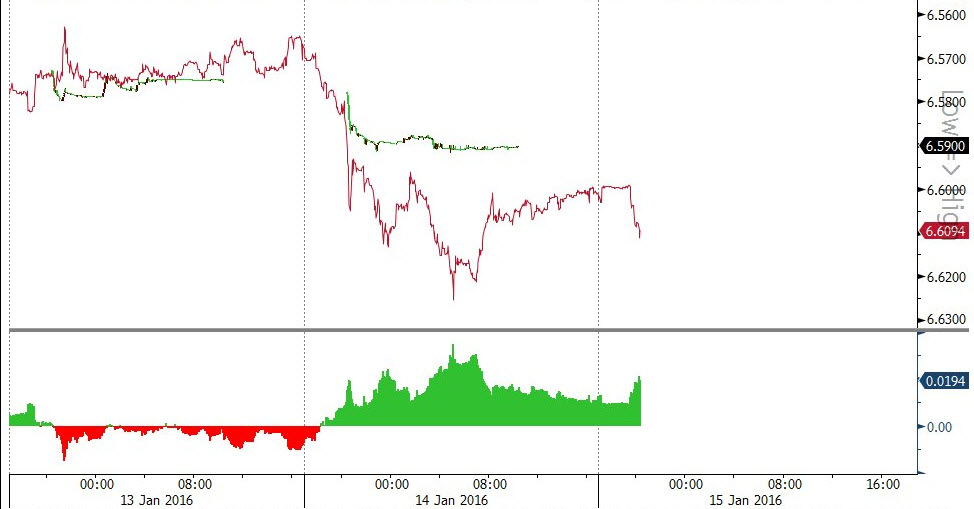

Having made its warning to the Fed loud and clear (“if you hike or otherwise push the USD any higher, we will crush your markets by devaluing the Yuan against everyone but mostly the USD“), the PBOC continued the fragile ceasefire between the world’s two most powerful central banks, when moments ago it kept the onshore Yuan virtually unchanged, by weakening today’s fixing by 0.03% to 6.5637. However, as can be seen on the chart below, this has barely even registered.

The lack of any action in the onshore Yuan has been mirrored in the offshore version of the currency as well, where the CNH has likewise barely budged as shorts have learned their lesson for the time being and few, if any, are willing to risk seeing an 80% overnight margin increase once the Beijing artillery comes storming in and soaking up liquidity.

But while China’s currenc(ies) have been a snoozefest so far, more interesting things are taking place in Hong Kong, where the dollar, which plunged yesterday the most since 2003, has rebounded in early trading, but after initially surging to 7.7746, the biggest jump since March 2015 has once again proceeded to weaken now that capital outflows are taking place through Hong Kong.

We are curious to see just how the PBOC will plug this particular capital outflow gap next.

Finally, after yesterday’s furious intervention-driven rally in Chinese stocks, moments ago the Shanghai Composite opened for trading below 3000, and as of this moment was lower by about 0.4% to 2,992, suggesting it will be yet another busy day for the PBOC which not having to worry about manipulating its currency can focus on manipulating the stock market instead.

Leave A Comment