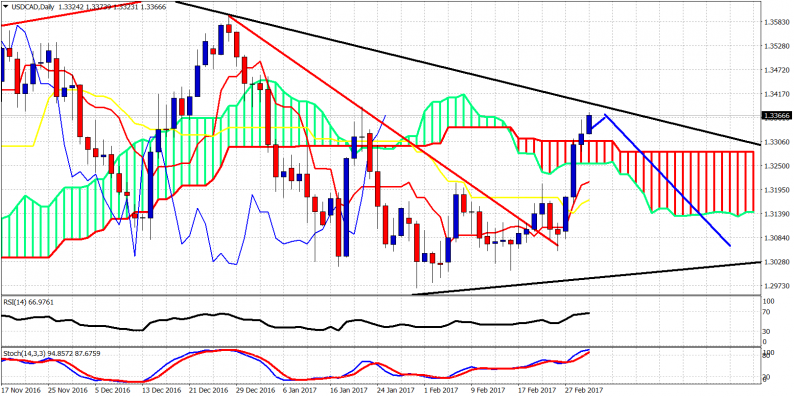

One of the forex pairs I will be focusing over the next few months is USDCAD. I believe that is currently back-testing broken long-term support from May 2015 lows at 1.24. I expect that as long as price is below 1.36 (risk 250 pips) the chances of a downward move similar to the decline from 1.46 to 1.24 could repeat itself targeting 1.15-1.10 area. In the short-term, we are approaching resistance by the downward sloping trend line connecting 2016 highs.

A rejection around 1.3370-1.34 could be the signal we need to confirm the inability to retake 1.36. Bears need to see a lower high being formed around these levels and below 1.36. Confirmation of our bearish view will come on a new break below 1.30-1.2950.

On a weekly basis, a break below 1.32 will also be an initial bearish signal. However strong resistance is here at 1.34 where we back-test the broken upward sloping channel. On the other hand, a pullback that will not break below 1.32 and create a higher low, will increase the chances of re-testing 1.36. Price is currently inside the weekly cloud, implying trend is neutral. That is true…neither bullish or bearish scenario is the clear favorite yet. Only from a risk-reward perspective, we can say that we would prefer the bearish scenario.

Leave A Comment