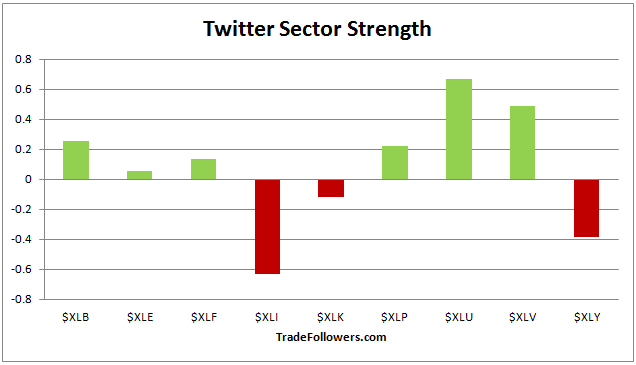

This week it looks like market participants are mixed in their opinions of the market (OK, more mixed than normal). It appears that there is a crowd that thinks the current down trend is overdone, while others believe it may be the start of something larger. The strongest evidence comes from Twitter sentiment for the sectors. Investors are getting bullish on recent lagging sectors like energy, basic materials, and financials. This indicates they’re dipping their toes in the water in these sectors, expecting a rally out of the current lows. Another set of investors are selling their technology and consumer discretionary stocks and rotating to the defensive sectors of consumer staples and utilities. This indicates they believe the current dip could morph into at least an intermediate term correction.

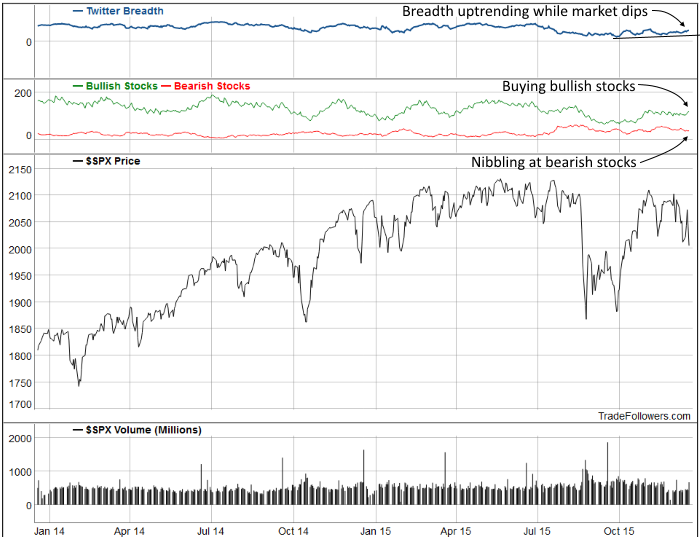

Another sign of buyers during this dip comes from breadth calculated between the number of bullish and bearish stocks on the Twitter stream. Breath is moving up slightly as the market dips. The cause is an increase in the number of bullish stocks and a decrease in the number of bearish stocks. Both high fliers and beaten down stocks are being bought.

Here’s the top of the most bullish list. It contains a lot of technology stocks even as the the sector as a whole shows negative sentiment. This tells me that the buying is selective and investors are looking for value. You can see the entire bullish list here.

Twitter momentum and sentiment for the S&P 500 Index (SPX) shows a slightly bearish picture. 7 day momentum couldn’t move back above its confirming down trend line on the last rally. That indicates the short term down trend is still alive. Bulls want to see 7 day momentum move back above the down trend line.

Another sign of intermediate term buyers vs. sellers comes from daily momentum. It is printing extreme readings on both sides of zero with muted volume and intensity. Some of the lack of volume of tweets is due to the upcoming holidays, but volume also often drops when the buyers aren’t in direct conflict with the sellers. I generally see large volume spikes when the market falls the way it has for the past three weeks. Looking at individual tweets usually shows disagreement between the buyers and sellers where the volume of bullish tweets rises in response to the bearish tweets. That’s not happening now. In fact, both bullish and bearish tweet volume is falling. This indicates that soft buying and selling is occurring rather than the type of battle we saw before the market broke below 2040 in August.

Leave A Comment