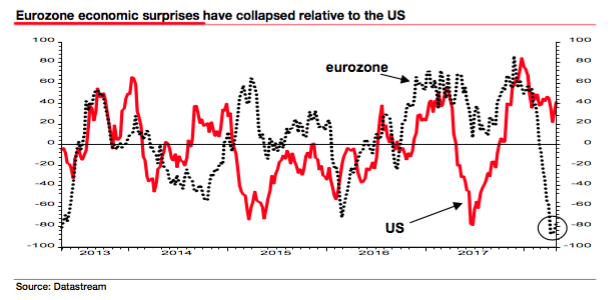

Is the U.S. the “last man standing” when it comes to the (previously) synchronized global expansion? I don’t know, but what I do know is that the idea of synchronous global growth has been undermined recently by soft data in Europe.

Surprise – it’s falling apart:

(SocGen)

I mean, maybe not. There are some supply-side constraints there and if you wanted to, you could trot out the usual list of reasons why the deceleration is “transitory”, as Draghi did in the April ECB meeting presser.

The idea behind the U.S.-centric, “last man standing” story is simple: the sugar high from Trump’s late-cycle fiscal stimulus will prolong the stateside expansion despite it now being the second-longest in recorded history.

But, as Goldman notes, the data is starting to slow in the U.S. as well and when it comes to what clients are asking about, they’re looking straight through upbeat Q1 earnings to the larger issue about the cycle. To wit, from a note out Friday evening:

Despite the strong 1Q earnings growth reported by so many companies, the top question from portfolio managers is actually macro-related: “What is the timing of the next economic downturn?” Although the US Current Activity Indicator (CAI) suggests an economy growing at an above-trend pace of 3.1%, the second-derivative shows growth deceleration, raising investor concerns. The Goldman Sachs US MAP index – a measure of economic data surprises – turned negative in April. Friday’s non-farm payroll gain of 164K jobs was below the 192K consensus forecast although the unemployment rate fell to 3.9% vs. 4.0% expectation. The ISM manufacturing index registered a nine-month low and disappointed relative to the consensus forecast (57.3 vs. 58.5). Similarly, the ISM non-manufacturing index was also below expectations (56.8 vs. 58.0).

So that’s the “bad” news.

Leave A Comment