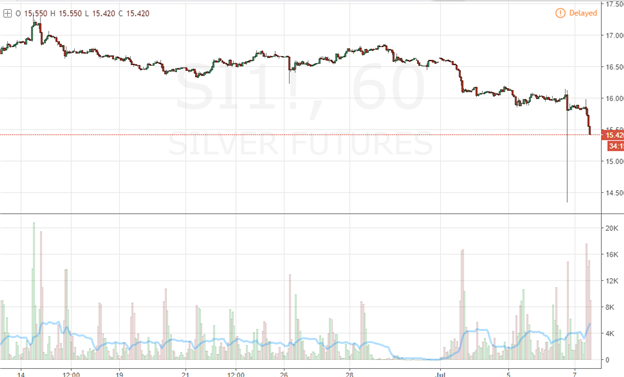

The scourge of flash crashes has clearly not been purged from the financial system. Silver suffered a painful stumble in the ‘afterhours’ trading following the US Thursday close and before liquidity could charge Asia’s Friday session. In less than a minute, the precious metal collapsed nearly 11 percent in the futures market and promptly reversed course. There was no ‘fundamental’ explanation to justify this collapse which suggests ‘market conditions’ in computer influences during an illiquid period. The impact was not isolated to silver either. While its stumble was far less painful, gold nevertheless dropped approximately 0.5 percent in sympathy with the move.

Looking at the circumstances surrounding this move, we can see that there was an anticipated surge in volume in futures during the move as stops and entry orders would be tripped and market orders scrambled to join the rebalance. When the liquidity of the US market returned, the slide was taken back up but at a more moderate pace. Volume was heavy through the decline.

Historically, the day’s range looks to be the biggest since a similarly shocking move on December 1, 2014. That dramatic move was also labeled a flash crash. There have been a number of these temporary collapses and reversals over the years, with the last move of this magnitude without immediate correction all the way back to April 15, 2013.

Looking beyond the explosion of volatility, the commodity is still progressing lower. At this pace, the market will still close at a 15-month low (the day’s low drove us to levels not seen in 17 months). Technical traders may note on a weekly or monthly chart, that this current development puts us in conflict with a rising trendline that is 12-year’s in the making as support.

Looking at speculative positioning to see how existing exposure may have contributed to the ultimate move, the CFTC’s Commitment of Traders’ report showed net speculative holdings of the metal were net long by 35,532 contracts as of last week – almost exactly a third of the bullish skew peak just a few months ago. Retail exposure was far more extreme – and remains so after the shakeup. Currently, retail traders are over 90 percent net long on the market. This looks like an effort to call a bottom which is a risky view not just because of the specter of another flash crash but due to the more gradual bear trend.

Leave A Comment