Stocks may have technically made a fourth straight weekly gain last week, but the real story was the incredibly quiet, flat market action. We’ll delve into overall stock market index analysis, and some factors that have us concerned despite the overall bullish trend momentum picture, after we take a look at the recent and upcoming economic releases.

Economic Data

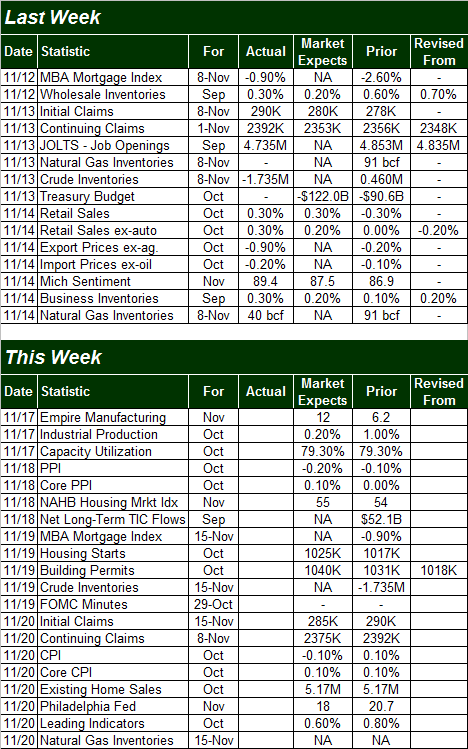

While there was a moderate amount of economic data to work through last week, truthfully, only a couple of items were of any real consequence.

First and foremost, last month’s retail sales weren’t great. They weren’t bad. They just weren’t great. Analysts were expecting a 0.6% improvement of retail spending overall (with or without automobiles), but we only saw a 0.3% uptick (again, with or without automobiles). That being said, a closer look at the details reveals that super-cheap oil and therefore super-cheap gas were the chief culprits for the shortcoming. Had it not been for the plunge in petrol prices, retail spending would have actually been up 0.5%.

Whatever the case, consumers are still doing their part – doing enough – to keep the economy humming, even if October’s actual numbers were less than hoped.

The only other piece of economic data from last week worth mentioning (the weekly initial claims figures have largely become irrelevant since they misleadingly exclude a large chunk of the non-working population) was the Michigan Sentiment Index score, and even that piece of data should be taken with a grain of salt… since it’s going to be revised two more times this month. To the extent it matters though, the initial November reading for the Michigan Sentiment Index was 89.4, up from October’s final score of 86.9. That confidence trend has been moving upward for years, and it looks like we’ll see at least one more step higher.

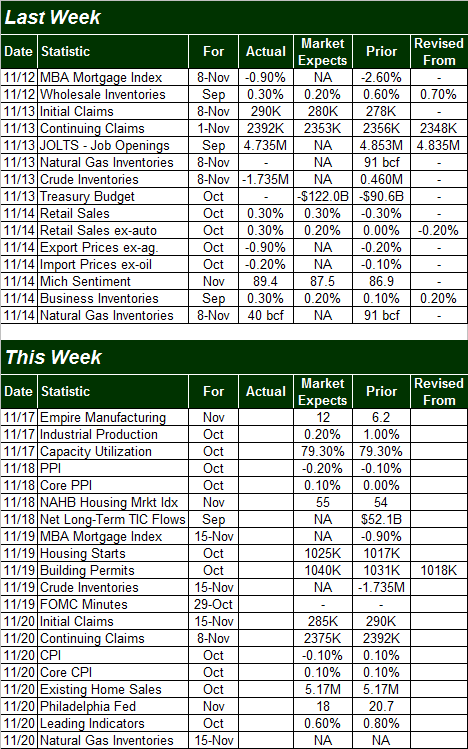

Economic Calendar

Source: Briefing.com

The coming week is not only going to be much busier on the economic data front, but a few of the data points in the lineup are hard-hitting things.

Leave A Comment