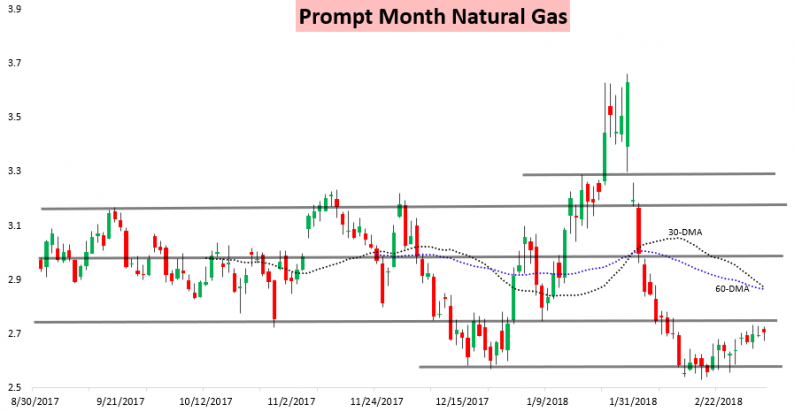

Yet again April natural gas prices traded within a very narrow range of just 5.3 cents today, settling up a third of a percent after a modest gap up last evening.

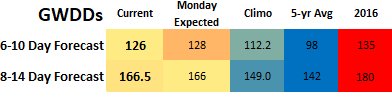

Prices initially gapped up on modest GWDD additions in the medium-range, like we had warned in our Pre-Close Update on Friday.

Sure enough, our 6-10 and 8-14 Day GWDD forecasts today were very close to our Friday expectations, as we helped clients prepare in advance for minor weekend forecast adjustments.

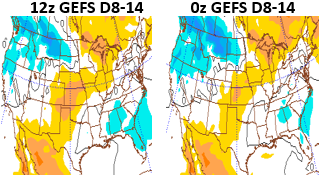

It became clear weather was still playing at least some role in price action when prices initially dipped off a warmer run of the American GEFS before recovering back into the end of the day (images per Penn State E-Wall).

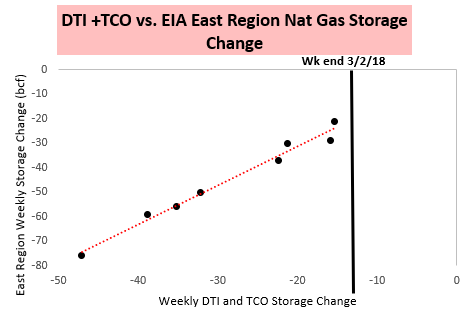

Along with these forecast trends, traders are eying what should be a rather limited withdrawal to be announced on Thursday. The withdrawal looks to be the smallest since Gas Week 49 of 2017 when we saw 69 bcf of gas withdrawn from storage. Columbia Gas Transmission (TCO) announced today their smallest weekly draw from storage so far in 2018.

Combined, TCO and Dominion (DTI) had their cumulative smallest draw of the season as well. This makes it likely that the East Region as a whole will also feature a smaller withdrawal than it has thus far in 2018 too.

For those keeping an eye on the weather, this should not be much of a surprise given the amount of warmth across the East last week.

Still, the print should provide further insight into current supply/demand market balance and lingering sensitivity to weather. Last week we used our analysis to get the print exactly right at -78 bcf, and will continue to provide subscribers with our latest EIA estimates daily.

Leave A Comment