Tech fundamentals have been very strong. Capex trends are picking up. Demand is spreading out not just through Cloud/Hyperscalers but also deeper into more traditional companies. Shouldn’t this be catapulting the stocks? Let’s review.

Multiple Drivers To Tech

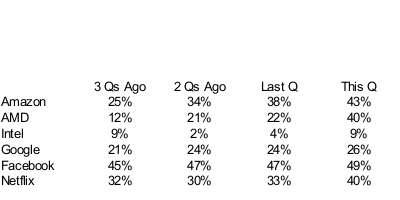

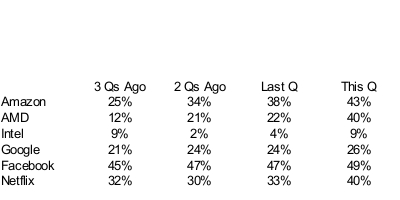

We’ve been writing that many major tech reporters saw accelerating revenues. Momentum investors usually love that.

Here’s that list.

Cloud/Hyperscalers have been leading the tech spend and many announced accelerating capital expenditure trends (“Capex”) as they are more confident in their revenue trends.

Add to that, the growth is no longer only coming from the big cloud spenders but tech spending is spreading out to more traditional companies everywhere, referred to as “enterprise.”

So Why Isn’t The Market Absolutely Going Nuts?

The fundamentals are there. But as traders and investors there is no perfect world. We can love fundamentals but have to respect markets. For that you need some confirmation.

SPY 268

Thursday, May 3rd we wrote that the S&P 500 ETF SPY closing above 268 would be a key signal that the market can have follow through higher.

The market just so happened to exactly hit that level yesterday and bounce hard lower showing you the importance of that level.

Let’s look.

You see in the SPY chart to the left that 268 caused key action.

Not closing above that level keeps us from getting too bullish short term.

Yesterday’s bounce down also gives us conviction that this level is critical.

Enterprise Spend Gaining

One of the reasons you have growth rates accelerating for tech companies is that more traditional companies are finally adding to their tech budget.

Here’s what Intel said about “enterprise” picking up on their last earnings call.

“And we also saw growth in our enterprise segments for the second consecutive quarter, as macro strength continued…”

Leave A Comment