Too Much Money Supply Could Mean Surging Inflation

If you have a lot of something, its value declines. This is one of the first lessons you learn in economics 101. The exact same is true for money as well. If you have a lot of money supply, it leads to inflation.

iStock.com/macgyverhh

And over the last few years, the U.S. Federal Reserve has printed a lot of money.

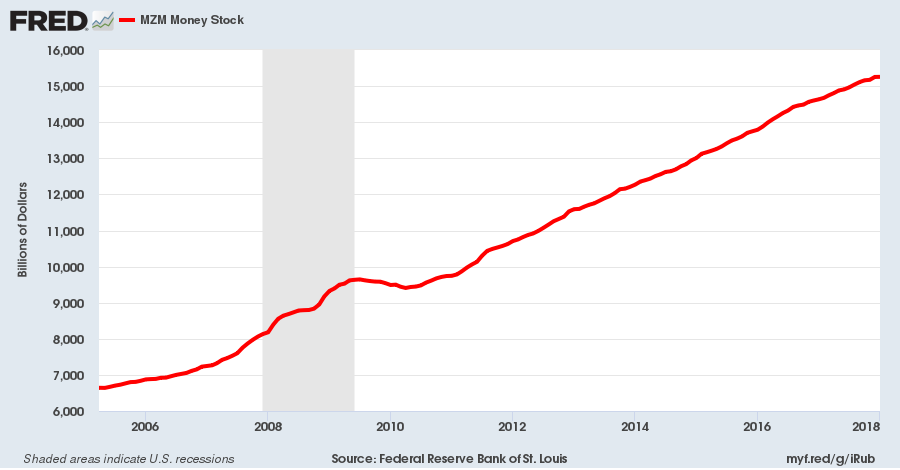

To give you some idea, look at the money supply chart below. Just before the financial crisis of 2008-2009, the money supply in the U.S. stood at roughly $8.0 trillion. Now, it stands at $15.25 trillion. If you do simple math, money supply has grown over 90% in the U.S. since then. (Source: “MZM Money Stock,” Federal Reserve Bank of St. Louis, last accessed March 5, 2018.)

You should also know that as the money supply was soaring, interest rates were kept low by the Fed as well. With this, banks didn’t really lend as much. A lot of the money was just sitting around and not being used.

Now, interest rates are increasing. What do you think banks will do? They will put the money to use.

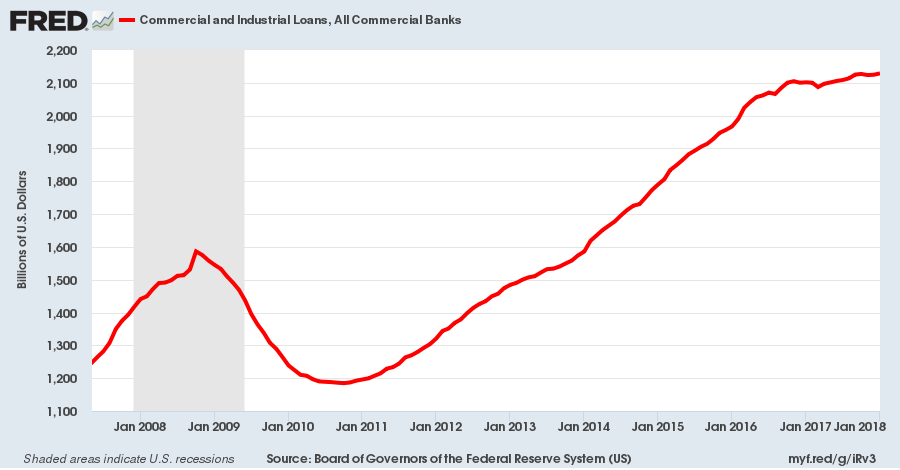

We see evidence of this. For example, look at the chart below, which shows commercial and industrial loans at U.S. banks:

Source: “Commercial and Industrial Loans, All Commercial Banks,” Federal Reserve Bank of St. Louis, last accessed March 5, 2018.

It was only in 2014 when commercial and industrial loans increased above 2008 levels.

What do loans have to do with inflation? Again, economics 101: inflation doesn’t really come in until consumption begins. With higher interest rates, a significant potion of the money that ias just sitting around could be put to use. And this phenomenon could send inflation soaring in the U.S.

Trump Tax Cuts Could Only Add to Inflation

But don’t just stop here. Not too long ago, the Trump administration cut corporate taxes. With this, companies in the U.S. will have more cash at hand as well going forward.

Leave A Comment