If we’re going to discuss Asian equities in the context of “awesome”, we should begin with Tencent. Tencent, which has more than doubled this year, drove Asian stocks higher during Tuesday’s trading session. Trading on the main board of the Hong Kong Stock Exchange hit a 28-month high of HK$157 billion with one fifth of it in only two stocks – Tencent (HK$21.7 billion) and Ping An Insurance (HK$9.4 billion). It was hardly surprising that shares in Hong Kong Exchanges & Clearing also had a good day, rising 5.5%, the most in more than a year. Tencent’s 2.4% rise pushed it market cap. above the illustrious $500 billion market, granting it membership of an exclusive tech-only club.

Just in case the frenzy in Hong Kong equities in general, and Tencent in particular, is making you a little nervous, Bloomberg reports that one of Asia’s top performing portfolio managers believes that we can expect more of the same in 2018.

One of the world’s best-performing equity gauges is set for further gains in 2018 as tech giant Tencent Holdings Ltd. and consumer stocks drive it higher, according to Shanghai-based money manager Wang Menghai.

The Hang Seng Index has led the charge among Asia’s biggest markets this year, rising 36 percent. Tencent, which has now overtaken Facebook Inc. in market value, accounts for nearly one-third of that advance. Wang, who works for Fullgoal Fund Management Co., has seen his fund beat 92 percent of peers in 2017. He plans to stay loyal to Tencent and boost exposure to companies that may benefit from quickening inflation.

“The Hong Kong benchmark is very likely to perform well in 2018, though the index rally may not be as much as this year,” Wang said in a phone interview. “Some of this year’s best performers are worth holding as long-term bulls.”

Wang’s had 9.68% of his Fullgoal SH-SZ-HK Value Selected Flexible Allocation Mixed Fund invested in Tencent at the end of Q3 2017. Speaking to Bloomberg, Wang noted that he was interested in “food and beverage companies and dairy and liquor producers” going forward because they will raise selling prices in the face of higher rates of inflation. This piqued our interest because the highest profile (and largest) Chinese liquor stock right now is unquestionably Kweichow Moutai. Last Friday, we discussed the highly irregular move by China’s Xinhua news agency which stated that Kweichow Moutai’s share price.

“should rise at a slower pace…short-term speculation in Kweichow Moutai shares will hurt value investing and long-term investment will deliver best returns.

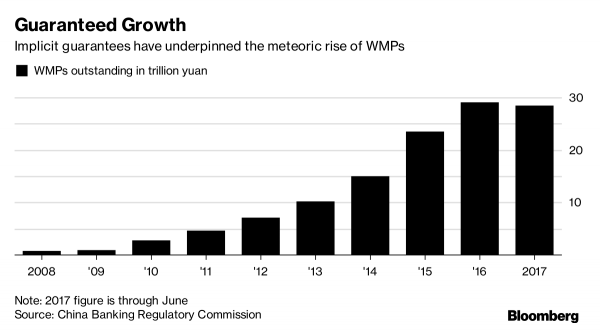

Perhaps investors like Wang don’t want to listen…that’s certainly the case of some mainland investors. After China announced the crackdown last Friday on shadow banking and its $15 trillion asset management products, Bloomberg reports that Chinese citizens don’t believe that guaranteed returns which have underpinned the $4 trillion wealth management products (WMP) Ponzi sector will come to an end.

But for Yolanda Yuan and other individual investors who’ve piled into AMPs issued by banks, insurers and securities firms, the government’s announcement was largely a non-event. The reason: they didn’t believe it. “I don’t think any big banks will dare to take the risk of allowing defaults on AMPs, as that will lead to a flood of fund redemptions,” said Yuan, a 29-year-old sales manager at a state-run financial company in Shanghai. She has about 100,000 yuan ($15,069) of personal savings in products covered by the new regulations.

“It’s very hard,” said David Loevinger, a former China specialist at the U.S. Treasury Department who now works as an analyst at TCW Group Inc. in Los Angeles. “You have to show people that there are no longer guarantees. The only way to show it is to force investors to take losses. They have to see it to believe it.” Chinese savers have come to depend on the stable returns promised by AMPs, most of which offer fixed rates and mature in less than a year. Bank-issued wealth management products, the biggest slice of the AMP pie, have proven remarkably reliable despite investing in volatile assets from corporate bonds to stocks and real estate. Among the more than 184,400 products that matured in 2016, just 88 suffered a loss, according to the government’s annual WMP report.

Leave A Comment