I see that Dartmouth economics professor Danny Blanchflower is talking about slack in the US labor market because he believes the Fed is premature in assessing its full employment mandate as fulfilled.

I have a few thoughts on this issue I want to flesh out below and the crux of my narrative revolves around the over-dependence on monetary policy as a policy lever.

First, let’s remember that some eight years ago, the US stock market was in the dumps, with the S&P 500 trading down to a multi-decade low of 666. Yesterday, the S&P 500 closed near its record high, at 2459, putting the 8-year gain at 270%. Spectacular.

But when one looks at the real economy, the results are middling, not spectacular. Nominal GDP growth has declined into a channel below 5% like the post-bubble Japanese economy. And that’s not just because of declining inflation. Real GDP growth has been of the2%ish variety, briefly hitting the 3% level on only a few occasions. That’s much worse than previous US expansions. So former US Treasury Secretary Larry Summers is calling this outcome secular stagnation.

But what’s more relevant is the jobs and inflation picture, where the Fed’s mandates are. Inflation has been below the Fed’s 2% target for five years and broader measures of unemployment continue to show slack. It’s this real economic picture that has Blanchflower criticizing the Fed’s rate hike train.

But let’s take a step back and ask why the Fed was at zero, to begin with, and why it’s still at 1% now even though this business cycle is in its ninth year already.

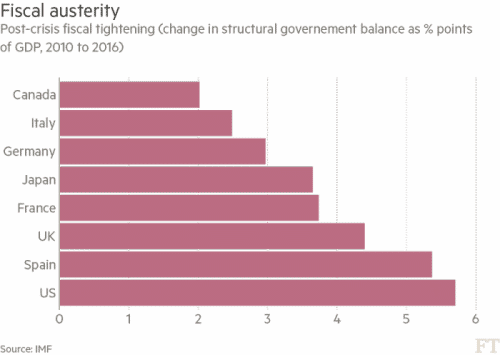

My answer is that monetary policy is the only game in town. In fact, if you look at the US compared to the rest of the G-7, fiscal policy has been tighter in the US than in any other country. It’s been even tighter than Spain, which has been forced to cut under the EU’s excessive deficit procedure.

It’s a Herculean task to ask the Fed to ‘fix’ the US economy after the greatest global financial crisis in 80 years, especially when the structural government balance has tightened almost 6%.

Leave A Comment