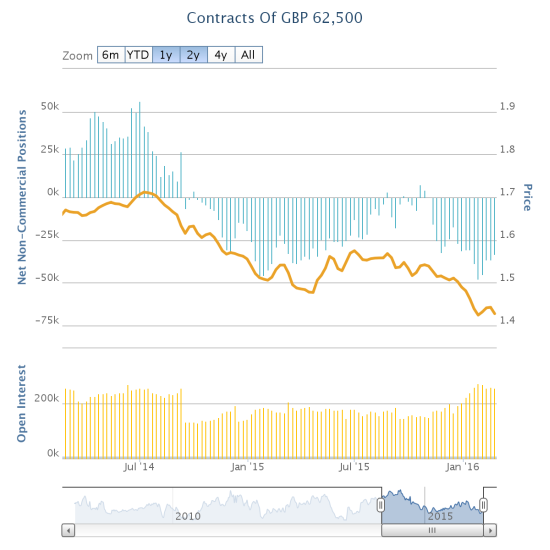

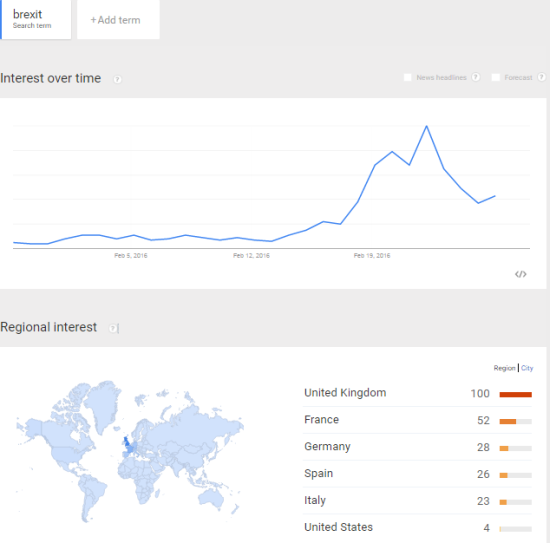

As I wrote in “Forget The Yuan – The Devaluation Of The British Pound Is Breathtaking,” I was eager to see how speculators would respond to the setting of a date for a referendum on “Brexit” and the subsequent stated support for Breixt by London’s Mayor. These vents heightened the stakes for Breixt; they sent traders first rushing into the pound and then rushing out of the pound with even more force for two days. If speculators responded with a surge in net shorts, I was going to assume a continuation in the pace of the current downtrend. If speculators responded with a continued retreat, I was going to assume that the losses in the British pound (FXB) would abate consistent with the cooling in Google Trends interest in Brexit. The vote is in. Speculators continued their retreat from the recent peak in net shorts. The current level is a 6-week low.

Speculators continue their retreat from net short positions against the British pound after the UK government sets a date for a Brexit referendum.

Source: Oanda’s CFTC’s Commitments of Traders

I am a bit surprised that the response was so muted. I expected a significant response one way or the other. Given this mild response, I will assume for now that the pace of losses for the British pound will continue to abate in line with the cooling in interest in Brexit.

Interest in Brexit is waning in the immediate aftermath of the UK government setting a date for the referendum. It is still very possible interest will bottom out at a very high level.

Source: Google Trends

The forex picture for the British pound was mixed on the week. From Sunday to Tuesday, the pound definitely weakened across the board as the fall-out cascaded from the Mayor of London coming out in favor of leaving the European Union (EU). After that point, the pound strengthened against the Japanese yen while it continued to slip against the U.S. dollar (DXY0). The U.S. dollar index strengthened most notably on Friday on the heels of a strong GDP.

Leave A Comment