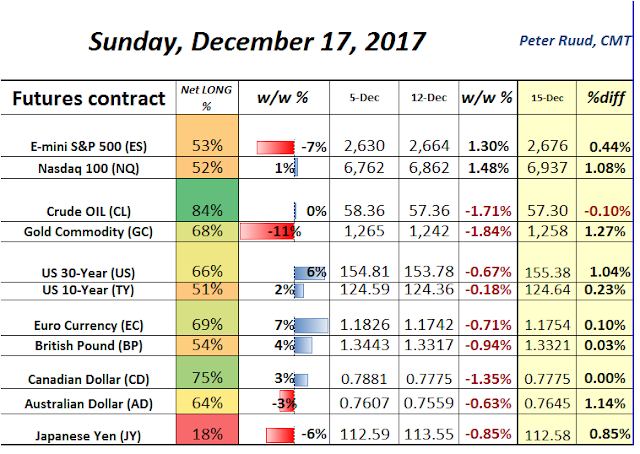

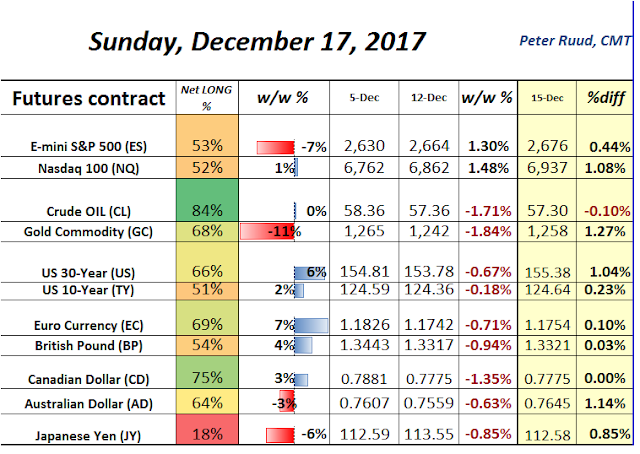

Speculators significantly reduced exposure to gold and S&P 500 futures, according to the latest Commitment of Traders (COT) report. Equity markets, meanwhile, continue to ignore the warning signs, closing the week at fresh record highs on the back of tax bill hopes. Elsewhere, euro speculation reaches another extreme and (non-commercial) treasury speculators continue to favor the long-end as the yield curve continues to flatten.

Gold futures (bullish) sentiment fell significantly, according to the latest COT report, as the number of (gross) long contracts were reduced by 25% and the number of (gross) shorts increased nearly 22%. As a result, net longs fell to 68% (as of Dec 12th) from 76%, the week prior. Meanwhile, Gold futures managed to recover off 5-month lows, finishing the week up over a percent. According to the latest retail positioning data, retail traders continues to buy in anticipation of a turn in the yellow metal. While gold futures technically turned (back up) last week, in order to follow the similar pattern seen back in May and July, the price of gold will have to move higher without hesitation in the short term. This means that the critical 1262/63 level will need to be cleared in the next week, in order to confirm the so-called “turn” in gold prices. The 200-day moving average and the key 50% retracement coincide with the next upside target at 1270 ahead of the 50-day moving average at 1277. If gold futures, however, fail to clear the 1262/63 threshold, then the 1240 region will likely be re-tested.

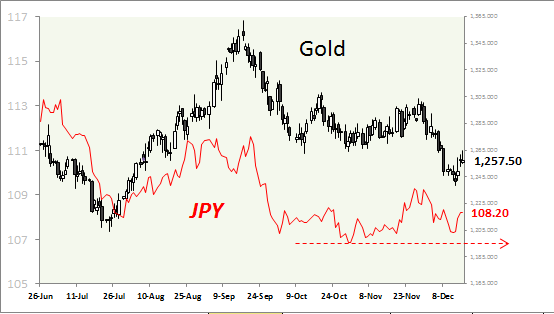

The (trade-weighted) Japanese yen and Gold futures have remained tightly correlated for some time, and in terms of price-action, both had fallen markedly since the end of November and both recovered last week. Yen speculators, however, are extremely (net) short and hover near the largest (net) short position for the year vs the USD. Meanwhile, the retail population has started to decrease their net long position (yen vs USD) to 47% from 52%, just a week prior. If the retail population continues to sell, there’s plenty of room for speculators to buy, given only 18% of the total (non-commercial) contracts outstanding are long. That said, while price-action in the USD/JPY remains north of the key 112 mark, technically there’s a high probability of re-testing key resistance at 114.33. If, however, the USD/JPY, manages to slice through key support at 112, then only 111.67, where two key moving averages reside, protect the 110.87/111.00 area from being re-visited to the downside.

Leave A Comment