Spiking Mortgage Rates – Soaring

Housing was weak this summer because affordability was a problem. Real wage growth basically trod water while interest rates soared. That’s not a recipe for strength in housing.

When you add in the increased costs for metals because of the tariffs, we’re in an unusually terrible situation for homebuilder stocks. Their prices reflect this as the ITB homebuilder ETF is down 26.18% since January 22nd.

The index is down 21.91% year to date. Homebuilder index peaked a couple years before the last recession. But housing isn’t going to cause a similar collapse in the economy this time: don’t panic.

The weakness in housing could start to hurt the overall economy if rates continue higher.

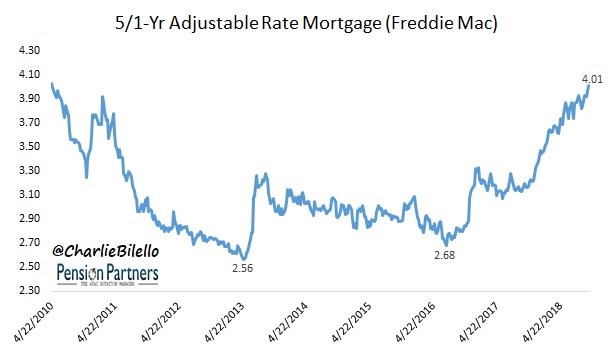

As you can see from the chart below, 5/1 year adjustable rate mortgages have the highest interest rate in over 8 years. When the 30-year mortgage interest rate increased from 3.85% to 4.71% in the past year, monthly payments increased by 10.7%.

For example, if monthly payments were going to be $1,400, they would be $1,550 instead.

Spiking Mortgage Rates – There Won’t Be Another Crisis

Mortgage rates depend on the credit score of the buyer, but all else being equal, rising rates make housing less affordable.

Housing prices need to come down to compensate for this. It might become a buyers’ market, affordability still won’t be great if rates are up.

The best buyers’ market was after the housing bust when prices fell. It was good last year in terms of borrowing costs, but prices were increasing.

Besides credit scores, location is a huge factor in home buying. Places like Denver, Seattle, and San Francisco have affordability crises because of prices.

Spiking interest rates could catalyze a sharp decline in those markets. Markets aren’t efficient. If someone held real estate for years during the uptrend, they will want to get out as the market craters to lock in some of their gains.

Leave A Comment