As a market manager I stay calm about it and use it to the best of my ability. As a human I get annoyed by it and what it does to the average (present company I assume, excepted) market participant. In a bear market the best rallies last just long enough to get the trend followers, touts and self-promoters back out on the stump. The best plunges reach their height of ferocity when the perma bears begin chest thumping (sort of like the dynamic with bullish gold bugs, except in reverse).

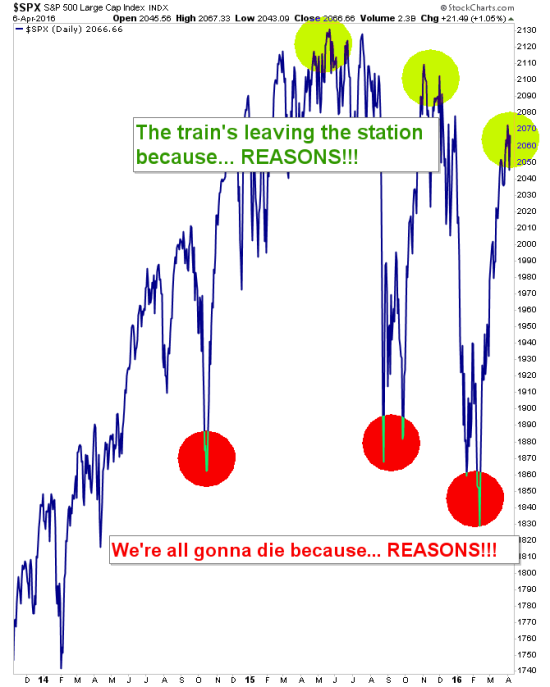

Here’s our highly technical chart of the S&P 500 explaining the highly technical situation that has seen bipolar pings up and down ever since the October 2014 extravaganza featuring a bogus Semiconductor sector call based on a supposed Semi canary’s bogus projections.

Here is what is actually going to happen, 100% for sure. The stock market is either going to find reasons to go up and break this lunatic cycle or it is going to find reasons to go down again and look for new reasons why the world is ending.

The funny thing is that we reviewed reasons that either of these eventualities could take place based on what is going on in the Treasury bond market’s Commitments of Traders data. Go have a look, and take into consideration short and long-term bonds and what the CoT’s implications might have on risk ‘off’ items and on the yield curve. In there you may find a case for a bullish stock market, but that same sword has an edge that is not so friendly to the stock market. Probabilities are still with the bears.

Yes, it’s the weird behind the scenes work that needs to be done in order to avoid becoming one of the red and green groups depicted above. But I have enough questions of my own (soon to be answered by our macro work) that I added a fundamental stock service to the list of premium entities I use to gain an ongoing edge for NFTRH and for myself. It will be helpful even if the market goes bearish from this point because I am expecting a big buying opportunity later if SPX reaches the 1500’s and while I have my favored stocks, I’d want real fundamental stock analysts on the job.

Leave A Comment