Bulls put foot down on major US equity indices last week. They have the ball near term. Shorts with medium-term focus can sell weekly puts to raise the short price.

The greenback acts strong. The US dollar index (95.98) hit a 13-month high last week. The week before, it rallied past 95-plus, which provided resistance for 10 weeks before breaking out. Soon afterwards, it began giving out signs of fatigue. In the past five sessions, the daily chart produced a long-legged doji, a shooting star and a hanging man.

Between the intraday low of 88.15 on February 16 and last Wednesday’s high of 96.87, the dollar index appreciated 9.9 percent – in six months. Not a chump change for any currency. So a little giveback is perfectly natural. The question is, will dollar bulls step up to defend 95 when the time comes?

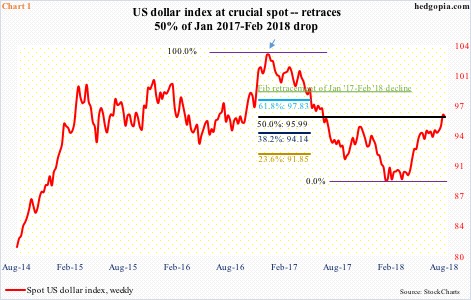

The index began retreating last week at an interesting juncture. It dropped from 103.82 early January last year to this February’s low of 88.15. A 50-percent retracement of that decline lies at 95.99 (Chart 1). Further, in the last decade it went from 121.21 in July 2001 to 71.33 in April 2008, followed by a rally, retracing 61.8-percent of that decline by January last year. The subsequent decline had dollar bulls persistently defending 88-89 in January-April this year. This led the foundation for the latest rally, which has now completed 50-percent retracement of the July 2001-April 2008 decline.

At least near term, the dollar index looks ready to unwind its overbought condition. But what if 95 is defended and the index proceeds toward the highs of January last year (arrow in Chart 1)? This scenario potentially comes true particularly if the Fed maintains its current tightening posture.

After leaving rates at the zero bound for seven long years, the Fed in December 2015 raised the fed funds rate by 25 basis points to a range of 25 to 50 basis points (arrow in Chart 2). Since then, there have been six more hikes. Markets expect another raise in September (futures imply 94 percent probability) and likely another in December (65 percent). By then, the fed funds rate will be between 225 and 250 basis points. Next year, the FOMC dot plot expects three more 25-basis-point hikes. Markets expect one hike next year. Three hikes are not in the price. Should the Fed be right, the dollar index likely gets rerated.

Leave A Comment