I had suggested last week that a retest of support at 2800 would be a possibility as the market had gotten very overbought as it approached the January highs.

“With moving averages rising, this shifts Pathway #2a and #2b further out into the August and September time frames. The potential for a correction back to support before a second attempt at all-time highs would align with normal seasonal weakness heading into the Fall.

As shown in the updated “pathway chart” above, the market did indeed attempt to test all-time highs in the market. But, as I noted, the overbought condition provided the fuel for a correction given the right catalyst.

That catalyst appeared on Friday as the Lira plunged and Turkey edged closer to an economic crisis.”

The market continued to stumble early last week and quickly fell to retest the 2800 level as concerns over Turkey rattled markets globally. However, with the algo’s eyeing that 2800 support level, when news was floated on Thursday and Friday that China is discussing “coming to the table” to resolve the trade dispute, that was the news needed to spark a robot-driven “buying” spree.

It reminded of the movie “Up,” and how easily distracted markets have become.

The “bulls” are hard pressed to NOT give up on this market. Over the last several years, investors have been trained repeatedly to “buy dips” regardless of the“squirrels” that may scamper by. Such works…until it doesn’t.

Don’t get me wrong…we are right in there as well buying opportunity when we see it.

However, we are also well aware of the risk and manage it accordingly. Currently, there is a serious rotation occurring in the market currently which should not be dismissed. As David Rosenberg noted on Friday (courtesy of ZeroHedge):

“Is the stock market flashing an anti-growth signal?”

Simply put, recent market strength is being driven by the S&P 500 Index’s industry groups that are least affected by slower economic growth.

An index tracking four defensive areas – consumer staples, health care, telecom, and utilities – climbed 10.3% in the three months ended Thursday. A similar gauge of economically sensitive groups – consumer discretionary, energy, industrials and raw materials – gained just 0.5%.

With the incessant flattening of the US Treasury yield curve standing in direct opposition to the rise in US equity indices, Rosenberg concludes, ‘I’m asked what the Treasury market sees that the stock market doesn’t.’

His answer explains it all (now that the chart above has exposed reality):

‘They both see the same thing – a return to stall-speed growth. Look at how the cyclical stocks are faring against the defensives, like Consumer Staples vs Discretionary. Not exactly the prettiest of pictures…’”

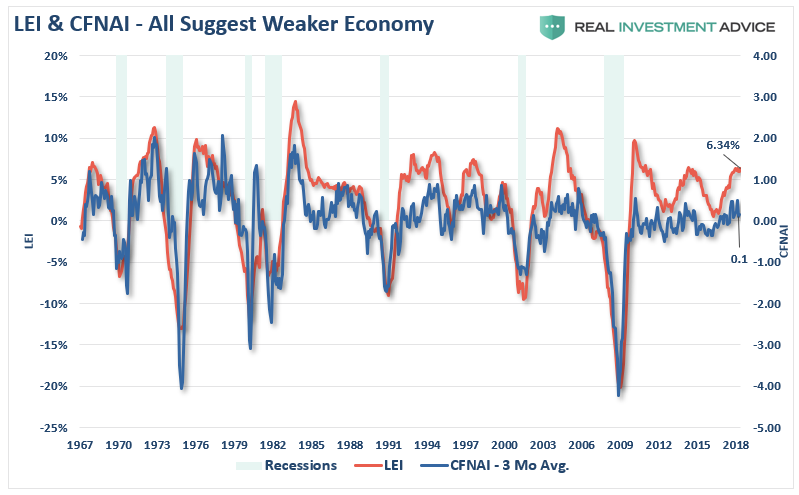

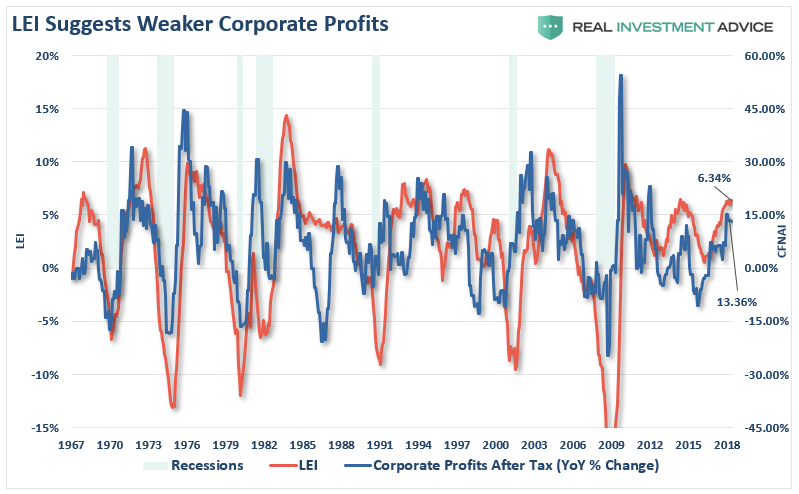

While the bulls have been quick to “price in” geopolitical and economic “squirrels,” the risk currently is a market which remains steeply overvalued, heading into a period of much tougher annual comparisons, and will likely see a contraction in economic growth rates. The data coming through already suggests the latter is likely. More importantly, the year-over-year rate of change in the leading economic index has also peaked suggesting the same.

(The chart below shows a projection at current growth rates out through 2020. Even if the LEI index grows from one month to the next, the rate of growth will slow due to annual comparison issues.)

With one of the broadest measures of economic activity already showing some weakness, a downturn in both the LEI and corporate profits should be expected.

All of this suggests that while the bias has been to the upside, there is evidence of a potential topping process at play.

The chart below is the S&P 500 index over the last several weeks. While this is a very short-term view, there is a potential “head and shoulder” formation in process. If completed, a subsequent retest of the 2800 level and a continuation of Pathway #2a, as shown above, is likely. A move higher next week that takes out recent highs would negate this process.

However, a retest could happen next week as the Turkey crisis continues to develop. With the late day downgrade of Turkey on Friday to junk status by all three rating agencies, the risk of a further contagion will continue to develop.

Leave A Comment