As the saying goes, if something looks too good to be true, it usually is just that. This can often be applied to unusually high-yielding dividend stocks.

For example, Stellus Capital Investment Corp. (SCM) has a 10% dividend yield, which is very attractive on the surface. The S&P 500 Index, on average, has a dividend yield of just 2%.

Stellus is one of 405 stocks with a 5%+ dividend yield. You can see the full list of established 5%+ yielding stocks here.

Not only that, but Stellus pays its dividend each month, rather than each quarter like most companies. You can see the entire list of all 34 monthly dividend stocks here.

However, while double-digit dividend yields are very appealing in a low-rate environment, investors must make sure the dividend is sustainable.

Stellus has a very high payout ratio, which is teetering near 100%.

This article will attempt to find out whether Stellus’ 10% dividend yield is indeed too-good-to-be-true.

Business Overview

Stellus is a Business Development Company, or BDC. It makes investments in small, predominantly private companies, that are usually at an early stage in their growth cycles.

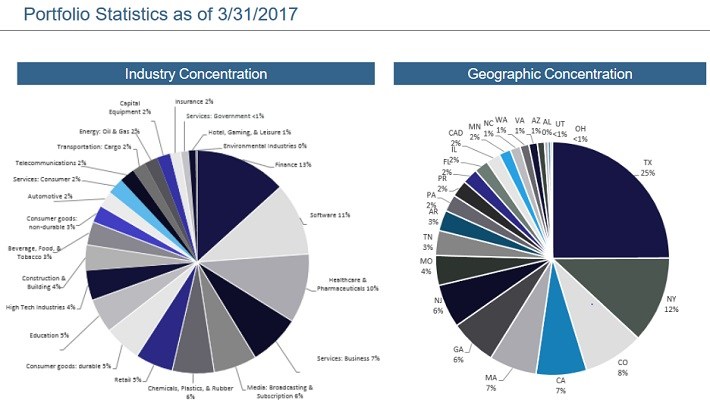

Stellus is a middle-market investment firm, and makes equity and debt investments in private middle-market companies. As of March 31st, 2017, Stellus had an investment portfolio of $352 million. It has a highly diversified investment portfolio, both geographically and in terms of industry concentration.

Source: Q1 Investor Presentation, page 13

The types of companies Stellus invests in, typically generate $5.0 million-$50.0 million of EBITDA (earnings before interest, taxes, depreciation and amortization). Stellus will make a variety of debt investments including first lien, second lien, uni-tranche, and mezzanine financing.

The investments are placed in a variety of industries, including business services, industrial, healthcare, technology, energy, consumer products, and finance. Invested capital is used for a wide range of purposes, including acquisitions, growth investments, and more. Stellus is externally-managed, by Stellus Capital Management LLC, a registered investment advisor.

Leave A Comment