The following company analysis is about my latest investment Hormel Foods, one of the most popular investments in the dividend investing community. In the last couple of months Hormel Foods experienced a decent drop in its share and like almost every stock in the consumer sector underperformed the market.

Company Overview

Hormel Foods is based in Austin, Minn. and is a multinational manufacturer and marketer of consumer-branded food and meat products, many of which are among the best known and trusted in the food industry. The company enjoys a strong reputation among consumers, retail grocers, foodservice and industrial customers for products highly regarded for quality, taste, nutrition, convenience and value. The company was founded in 1891 under the name George A. Hormel & Company and changed its name to Hormel Foods Corporation in 1995. Hormel Foods Corporation is based in Austin, Minnesota.

Stock analysis

Currently HRL is priced at $30.74 per share, which is 30.3% below its 5 year high of $44.09 in October last year. The drop in the share price is again one of typical market overreactions, driven by fears of lower margins etc.. But nevertheless you always should keep in that this company will stay profitable, even if they may lose some of its current margin.

Current Valuation

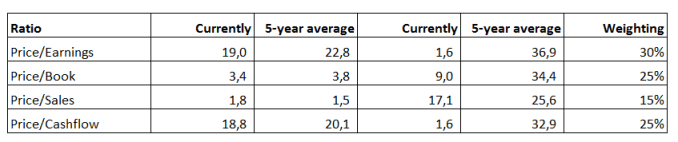

As you can see the current ratios are besides of the Price/Sales ratio all below the 5 year average. Using my current method to calculate a fair share price based on the 5 year average numbers, I would get a price of $31.71 so from that perspective the current level of the share is fair. If I use the Market Fair Value Ratio according to Morningstar I would get a price of $31.05.

The outlook for HRL is expecting a 5-Year growth of 6.2% which results in a forward P/E ratio of 18.1. In my further analysis I also included a simple calculation with the following Graham Formula:

![]()

,

The result was a price of $33.02.

So all in all you can say that Hormel Foods is fairly priced and currently definitely a stock to watch in the next couple of weeks.

Leave A Comment