As the Fed nears its proposed first rate hike in nine years the stock market is becoming frantic. The Dow Jones Industrial Average is down around 10% on the year, as markets digest the troubling reality that our central bank may be raising interest rates into an emerging worldwide deflationary collapse.

The Fed normally raises rates when inflation is becoming intractable and robust growth is sending long-term rates spiking. However, this proposed rate hike cycle is occurring within the context of anemic growth and deflationary forces that are causing long-term U.S. Treasury rates to fall.

The yield curve spread, specifically the difference between Fed Funds Rate and the 10-year Note, is usually close to 4 percentage points at the start of major tightening cycles. This was the case at the start of the 1994 and 2004 campaigns to curb inflation. However, this go around the spread is less than 2 percentage points and the benchmark 10-Year Note yield is falling. This means the yield curve will invert very quickly and cut off banks’ profitability and incentives to lend; which will greatly exacerbate the deflationary impulses reverberating across the globe.

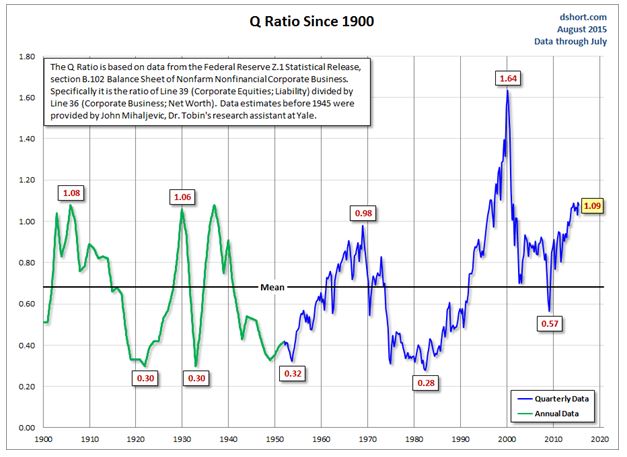

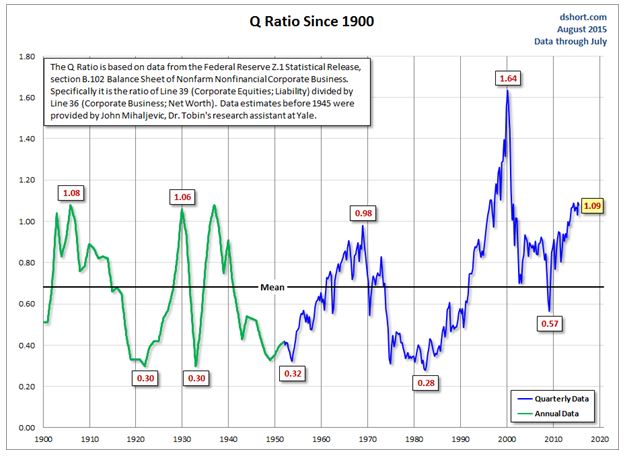

These deflationary forces will collide head on with a stock market that is already extremely overvalued as measured by Tobin’s Q ratio (the total value of corporate equities/replacement cost) and the total market cap to GDP.

Tobin’s Q Ratio:

Total Market Cap/GDP:

But the overvalued condition of stocks gets even worse when viewed in the context of anemic growth and the prospect of a hawkish Fed. Revenue growth, or the lack thereof, for S&P 500 companies was a negative 3.3% in Q2, leading to a minus 1% earnings growth for this benchmark Index.

U.S. GDP has not been faring much better, averaging a lackluster 2% annual growth rate since 2010. The highly accurate Atlanta Fed GDP Now has forecast GDP at just 1.3% for Q3, far short of what many perma-bulls on Wall Street are calling for.

Leave A Comment