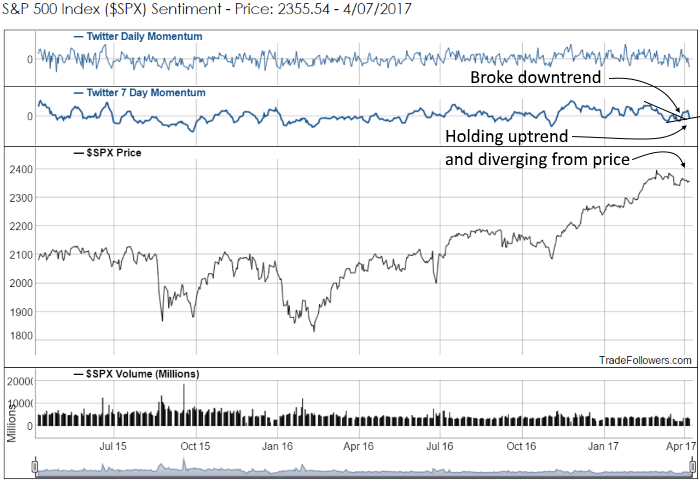

I’m seeing some positive signs this week from stock market sentiment on Twitter. First, seven day momentum and sentiment for the S&P 500 Index (SPX) has broken its downtrend line. This often results in price moving higher because sentiment has turned bullish. Price is trying to move higher, but isn’t quite there yet. As long as seven day momentum can hold the newly established uptrend line we should expect to see an attempt at new highs.

Breadth calculated between the most bullish and bearish stocks on Twitter is also improving. Most of the improvement comes from an uptick in the bullish count. This is what we want to see because it suggests traders are pushing the most bullish stocks higher as SPX is struggling. It should lead SPX higher.

Another good sign comes from traders’ price targets for SPX that are gleaned from the Twitter stream. We’re seeing scattered calls for 2450. However, 2400 is still showing as a strong resistance level. Expect the market to at least pause there before moving higher.

Conclusion

The consolidation on SPX is showing good support from sentiment on the Twitter stream. The number of bullish stocks is rising, Seven day momentum has started an uptrend, and traders are calling for prices above all time highs. So far, so good, but keep an eye on the newly established uptrend in seven day momentum. If it breaks, we will likely need more consolidation before attacking new highs.

Leave A Comment