The following stock valuation is about Coca Cola (KO). a company which has an impressive dividend history and is one of the consumer giants out there. But it is also a company which is struggling when it comes to growth in the last years. Nevertheless I still think it should be one of the core holdings of any dividend portfolio. Recently KO announced a dividend increase of 5.7% to new yearly dividend of 1.48 USD. But let’s have a look at the valuation and if it is already in my buying zone.

The Coca-Cola Company is the world’s largest beverage company. The company has more than 500 beverage products on the market including soft drinks, waters, enhanced waters, juices and juice drinks, ready-to-drink teas and coffees, and energy and sports drinks. The company was founded in 1919 and is based in Atlanta, GA. Coca-Cola is largely affected by health trends, as obesity and other health concerns reduce demand for some of Coca-Cola’s products. KO has increased its dividend since 1963.

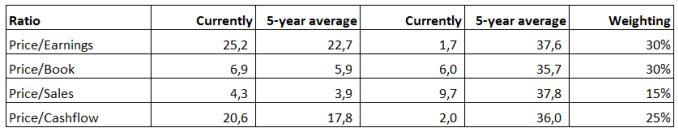

Valuation

Currently KO is priced at 41.72 USD per share.

If I take the weighted average of the 4 ratios according to the 5 year average the price would be at 36.7 USD. That means the current price is 13.8% above its 5 year average. The 5 year high was at 46.87 USD about 6 months ago, so currently the stock trades 11.0% below its 5-year high.

The fair market value ratio of beverage-soft drinks (consumer defensive), according to Morningstar, is currently at 1.06. If I divide the current price by it I will get a price of 39.36 USD.

Earnings per share growth

In 2011 the EPS were at 1.85 USD and EPS in 2016 were at 1.49 USD. This just means there was no growth in the last 5 years at all. Actually EPS decreased on average by around 4% per year.

Dividend History and Future

KO has an impressive dividend history, increasing the dividend for 54 years in a row. In the last 5 years, the average growth per year is 7.98% based on a dividend of 0.94 USD in 2011 and a current full year one of 1.38 USD. The payout ratio with 92.6% is already very high and if there will be no growth coming up in the future it will be a problem.

Leave A Comment