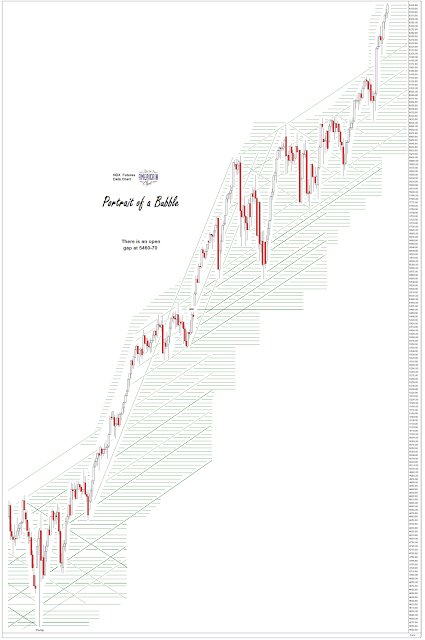

What is driving US equity prices now is classic bubble action. Stocks are being bought, not with regard to any fundamentals for the most part, but for the sheer momentum of ever rising prices by speculators.

Having created this asset bubble, again, in conjunction with the financiers and Wall Street, the Fed is deathly afraid of anything that will break the mirage and put the banking system at risk.

And we are seeing, like a dog returns to its vomit, the Banks start taking up the kinds of leveraged risks that brought us to the brink in the great unwinding of the housing bubble in 2008.

Surely they must care. Surely they must have a caution for the damage they will cause to untold thousands of innocents.And if not the money men, then those who are sworn to restrain their greed.

As John Kenneth Galbraith observed in his masterwork, The Great Crash of 1929, ‘The sense of responsibility in the financial community for the community as a whole is not small. It is nearly nil.’

And you can toss in the political and corporate media elite in there as well.It’s a club, and you aren’t in it.

Leave A Comment