Yeah, this happened…

And so did this…

So this…

April was a volatile month in markets – bonds, bullion, and stocks higher; crude, copper, and base commodities all tumbled

Bonds, Bullion, and Stocks all rose around 1.25% on the month, but Banks were down in April (and March) for the worst 2-month drop since Feb 2016.

Tech led the month, Energy lagged…

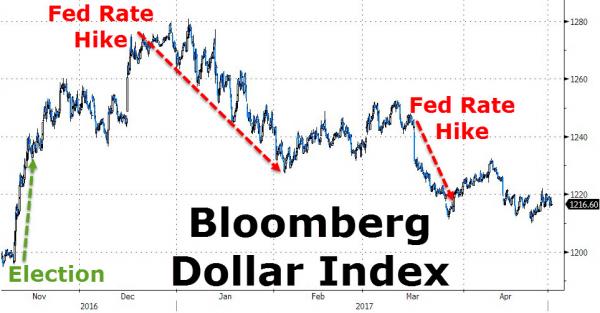

Dollar Index fell for the 2nd month in a row (3rd of 4) erasing most of the gains post-Trump

* * *

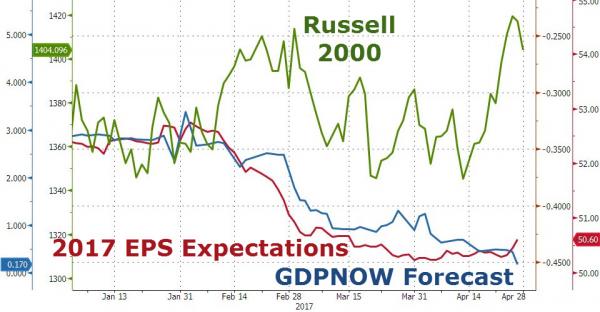

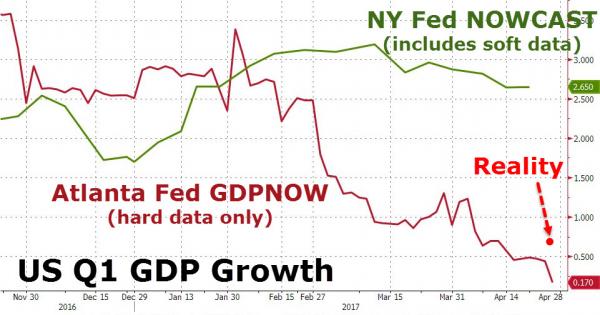

It was a tough week for ‘soft’ data and reality-checks – who do you trust to forecast reality?

But stocks were all higher (apart from Trannies)…The best week of the year for The Dow!!! But it ended on a weak note…

Small Caps were hit hard today as “Most Shorted” stocks’ squeeze seemed to end…

Utes were the only sector red on the week, Healthcare and Tech led (with Financials solid post-Macron)…

Breadth has remained weak in this entire recent surge…

Leave A Comment