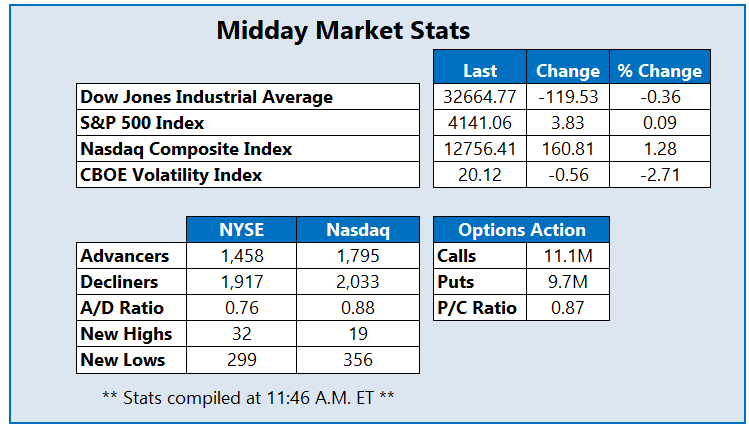

Stocks are mixed midday, as investors unpack the latest corporate earnings reports, as well as personal consumption expenditures and consumer spending data. Amazon’s (AMZN) post-earnings pop is propping up the Nasdaq Composite (IXIC), though the tech-heavy benchmark is still on track for weekly losses alongside the other indexes. The Dow Jones Industrial Average (DJI) was last seen down triple digits, while the S&P 500 Index (SPX) is muted.

Intel Corp (Nasdaq: INTC) is the most popular stock amongst options traders today. The shares are up 8.3% at $35.22, following the company’s better-than-expected third-quarter results and strong forecast. A handful of analysts chimed in with bull notes, with HSBC upgrading shares to “hold,” while others hiked their price targets. So far, 165,000 calls and 137,000 puts have been traded, which is already five times the average daily options volume. The weekly 10/27 36-strike call is the most active, with new positions opening there. Intel stock’s 200-day moving average captured yesterday’s pullback, with shares up 33.7% in 2023.

The New York Stock Exchange’s (NYSE) Decker’s Outdoor Corp (NYSE: DECK) is up 19.2% at $577.91 at last glance, after the company’s strong fiscal second-quarter results and raised outlook. No fewer than seven firms lifted their price targets on DECK as well. Since the start of the year, the equity is up roughly 45%. Meanwhile, Vivos Therapeutics Inc (Nasdaq: VVOS) is at the bottom of the Nasdaq today, down 41.5% to trade at $3.79 at last look, and slipping into penny stock territory. This negative price action comes after the company revealed a 1-for-25 reverse stock split. So far in 2023, VVOS is down 63%. More By This Author:Stocks Log Lowest Close Since Late MayNasdaq Down Triple Digits After #Meta #EarningsNasdaq Clocks Lowest Close Since February

Leave A Comment