Asian markets dropped following disappointing China trade and Japan GDP data, while European stocks rebounded for the first time in five sessions led by miners and banks. US futures were little changed as the dollar strenghtened, pressuring oil further below $53; sterling slid for the eighth day out of nine, dropping under 1.215 before the chancellor of the exchequer delivers his spring budget. Treasuries are headed for their longest losing streak since 2012 ahead of a 10Y U.S. debt auction, and today’s ADP private payrolls report.

Following four sessions of losses, European shares edged up on Wednesday, with the Stoxx 600 index fractionally in the green, after minor gains driven by Chinese import data which signaled a recovering economy (just ignore the huge miss in exports), while the dollar rose before jobs numbers that could help cement expectations that U.S. interest rates will rise next week. Banks rose, while healthcare stocks fell after U.S. President Donald Trump said on Tuesday he was developing a plan to encourage competition in the drug industry. Britain’s FTSE 100 index rose 0.1% before finance minister Philip Hammond unveils his first budget since the UK voted to leave the European Union.

Today’s key event ahead of Friday’s payroll report is the latest ADP report where expectations are for 189k. It’s important only in so far as it will give us a guide to Friday’s payrolls which in turn will be the last employment data before next week’s FOMC meeting. With the probability of a hike now 96% (according to Bloomberg’s calculator which overstates a bit) it seems that the only economic data that could cause this probability to reverse would be employment on Friday or US CPI on Wednesday – the day of the decision. However the numbers would have to be large outliers to shift expectations markedly now.

Meanwhile, volatility for virtually all asset classes continues to slide. Ever since Donald Trump gave his speech to a joint session of Congress last week and Fed officials including New York Fed President William Dudley ramped up odds of an interest-rate hike this month, volatility metrics across the board have plunged.

Most Asian stocks fell amid lower trading volume.As noted last night, China’s imports in February grew 44.7% from a year earlier on a yuan-denominated basis and 38.1% in dollar terms, accelerating from the previous month and leading to a rare trade deficit. Exports rose 4.2%, missing expectations of a 14.6% rebound, and down from the 15.9% January gain.

On the other hand, as Goldman wrote after the report, the apparent weakness in export data seems to be inconsistent with (1) signs of stronger global growth (our global leading indicator is at a multi-year high), and (2) strong early readings of exports from neighboring economies such as Korea. Several factors might be at work, including The strength in global data has been more evident in terms of survey than hard data so far. However, the biggest culprit is said to be Chinese New Year distortions:

Our seasonal adjustment process is supposed to correct for these distortions when calculating the level of sequential growth. However, these distortions are often changing and with a small and changing effective sample there are large uncertainties related to these estimates. March data is likely to look better as the Chinese New Year distortion reverses. If year-over-year growth bounces back to January level, 1Q growth will still reach a decent mid-single digit level, a long way up from the trough a year ago.

China’s trade data briefly pushed the MSCI Asia-Pac index ex-Japan higher, although it later traded flat. Mainland Chinese shares dipped but Hong Kong stocks rose 0.4 percent. The Nikkei 225 (-0.5%) dropped after Japan’s Final Q4 GDP missed expectations. Hang Seng (+0.4%) and Shanghai Comp. (-0.1%) were choppy after the PBoC drained liquidity via reverse repo operations, leading to a 10th consecutive day of net outflows.

The Stoxx Europe 600 was fractionally in the green, rising 0.01 in latest trading, after declining a fourth straight session on Tuesday. S&P 500 Index futures pared earlier declines to trade little changed. The S&P500 lost 0.3% on Tuesday, completing the first back-to-back declines since January. Health-care shares declined after Republicans released details of a replacement for Obamacare and the president tweeted about lowering drug costs for Americans.

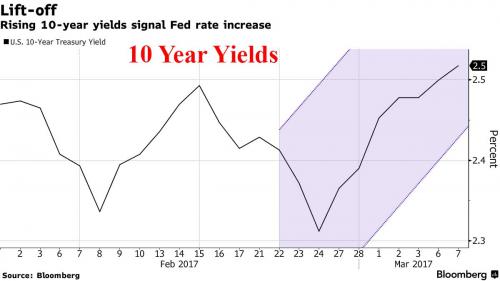

In the US, The yield on 10-year U.S. notes climbed for an eighth session and most government debt in Europe followed suit according to Bloomberg. Bank and commodity producer shares responded positively, putting the Stoxx Europe 600 Index on course for its first gain in five days. The British pound slid for the eighth day out of nine before the chancellor of the exchequer delivers his spring budget. There’s “a bit of supply pressure but there are bigger issues going on,” Padhraic Garvey, London-based global head of strategy at ING Groep NV told Reuters. “The bigger issue is the realization that we’re facing into a Fed hike event and a reasonably positive environment from a European growth perspective.”

In currencies, Sterling was an underperformer on currency markets, down 0.3 below $1.215. Below-forecast consumer spending data on Tuesday pushed the pound lower as it came after months of robust numbers and suggested the economy might be slowing. The euro weakened 0.1 percent to a day before a meeting of European Central bank policymakers. The dollar rose 0.2 percent against a basket of currencies. It hit a seven-week high last week as a host of Federal Reserve officials talked up the chances of a rise in interest rates as soon as the March 14-15 meeting. Traders were waiting for Friday’s U.S. jobs data as a final piece of evidence supporting a 25 basis point rise, which futures prices indicate is an 83 percent probability. The yen declined following the European open, trading up to 114.10.

Leave A Comment