The economy and stock market move in the same direction in the medium-long term. Hence, leading economic indicators are also leading indicators for the stock market.

Thoughts

Read Study: Heavy Truck Sales is sending a bullish sign for the stock market

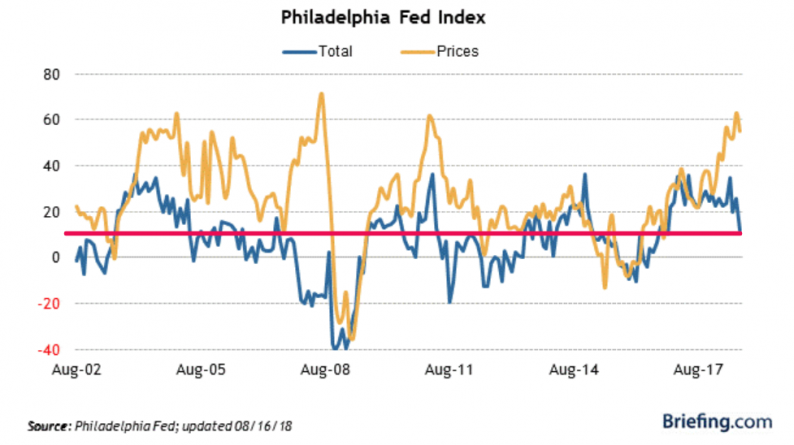

The Philadelphia Fed Index is falling. NOT bearish for the stock market.

The Philadelphia Fed Index has been falling recently, prompting some market watchers to become bearish. I don’t think they understand how limited in scope this index is.

The Philadelphia Fed Index is still above zero, which signals economic expansion, although the rate of growth is falling.

More importantly, this index is not very useful for predicting the U.S. stock market. As you can see, this index trended downwards consistently from 2004 – 2007 while the U.S. stock market went up.

Breadth continues to trend higher. A medium term bullish sign for stocks.

The NYSE’s advance-decline cumulative line (breadth indicator) just made a new all-time high.

This is a bullish breadth divergence. As demonstrated in this study, breadth leads the stock market higher. Historically, the cumulative Advance-Decline line trends down before a bear market begins (see study)

Wal-mart’s rally is not a sign of weakness in the stock market or economy.

There’s a lot of nonsense on fintwit that’s very popular. This nonsense does nothing but cause investors and traders to underperform in the long run.

Leave A Comment