Thoughts

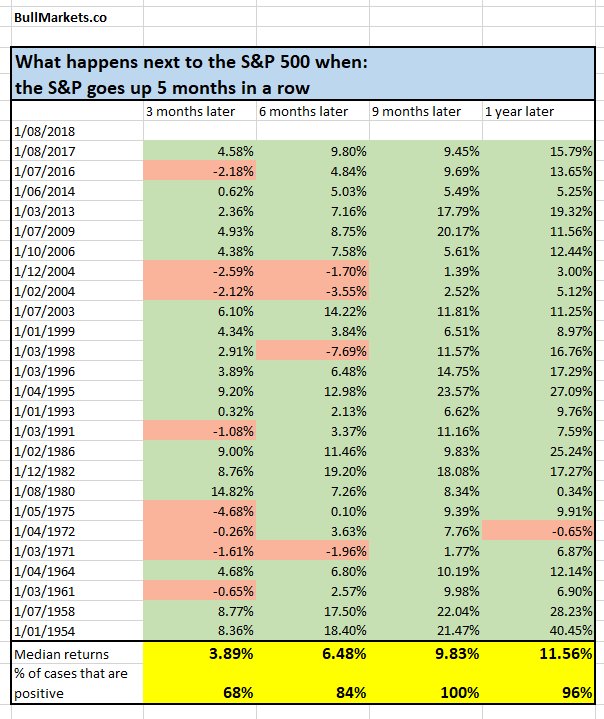

1 am: The S&P is up 5 months in a row. EXTREMELY bullish in the medium term.

It’s official. August is over, and the S&P is up 5 months in a row. When this happens, the U.S. stock market’s medium term outlook is very bullish (see study)

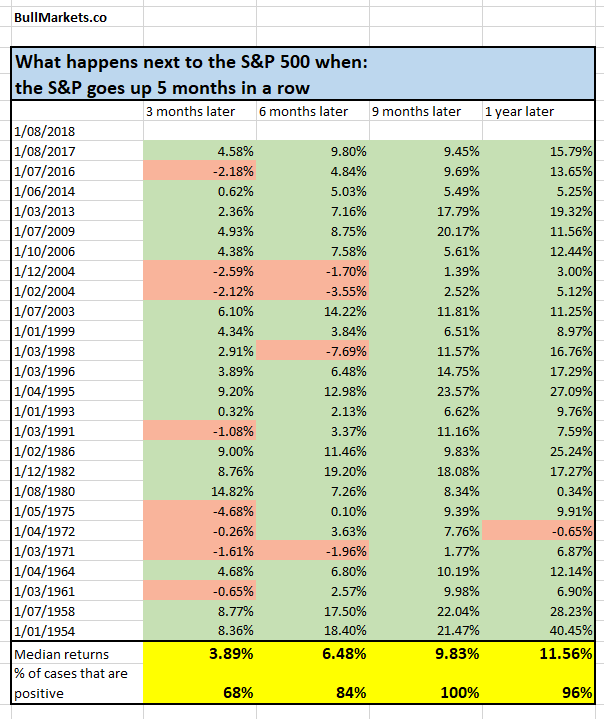

1 am: Volatility has been notably absent in August. Not as bearish as you think.

Volatility has been notably absent from the U.S. stock market this August. This has been the calmest August since 1967, with all daily moves less than 0.8% (CLOSE vs. CLOSE $)

Get my book!

Does this mean that volatility will increase and the stock market will fall in the near future?

No.

There have only been 3 historical cases in which all daily movements in August were less than 0.8%

Here’s how the S&P 500 did over the next 1 year. Not necessarily bearish.

1 am: Gartman remains bearish on U.S. stocks. You know what that means…

Dennis Gartman remains very bearish on U.S. stocks. From his latest newsletter:

It is far too early to suggest being short of equities, for we’ve tried that before and it proved unwise, but it is time for us to reiterate our admonition that one must absolutely refrain from adding to long positions. Even more certainly one must refrain from buying new positions!

Meanwhile in March 2018, Gartman predicted that “the U.S. stock market is at a multi-year top”.

For those who don’t know, Dennis Gartman is a rather reliable contrarian indicator. This is good news for equity bulls.

Leave A Comment