Disappointing Data this morning was trump’d by some de-escalation with North Korea and a short-term debt-ceiling can-kicking – stocks rallied, bonds & bullion leaked lower, and the dollar was unable to get back into the green…

Video length: 00:00:03

The biggest headlines of the day came out of DC (as usual) with Trump seeming to de-escalate his rhetoric with North Korea (prompting a drop in gold)…

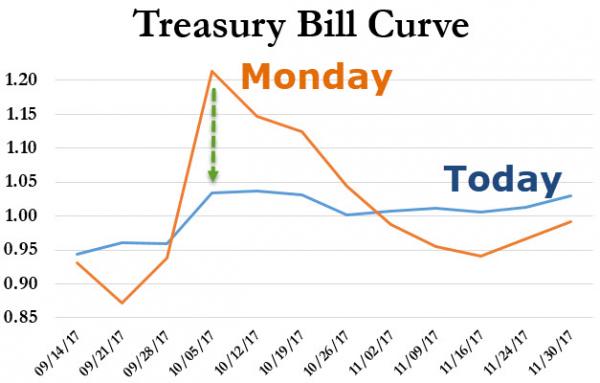

And then Trump acquiescing to Democrats’ demands on the debt-ceiling, sending gold lower and crushing October bill yields…

However, it merely kicked the can from October bills…

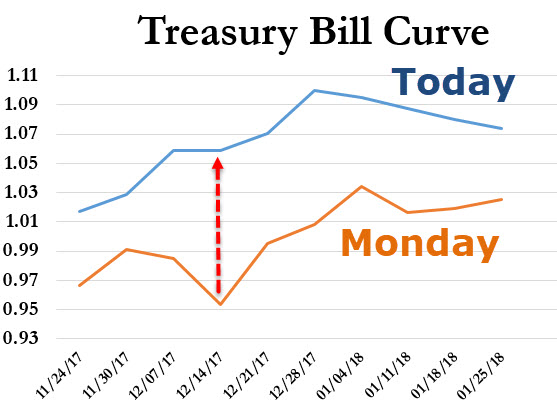

to December bills…

Some context for today’s bounce, however…

Equity markets got a boost from the news…but was unable to recover yesterday’s losses… (NOTE – stocks were weak into the close)

Two decent short squeeze efforts today to ignite some momo…

VIX was clubbed like a baby seal once again as all risks were removed from markets…

Vols across all major indices fell today but remain higher from Friday…

FANG Stocks were panic bid today – erasing all of the yesterday’s losses…

Bonds and Stocks remain completely decoupled…

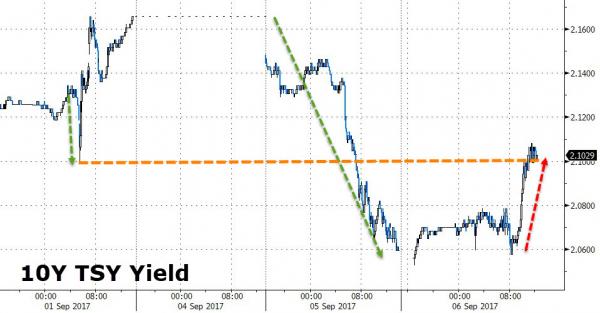

Treasury yields rose on the day, after the debt-ceiling deal was agreed, but in context, bonds remain lower in the yield on the week…

With 10Y Yield hovering at 2.10%…

The Dollar Index closed lower on the day, hit by weak ISM data…

The Loonie soared today after BOC unexpectedly hiked rates…

Leave A Comment