The recent action in stocks explains why you can’t follow the narrative. It spins on its head and reverses itself constantly. Listen to the narrative and decide if it makes sense. The headlines have said stocks have risen and fallen based on the same news on inflation and yields. If you followed the media narrative that said stocks were going to sell off because of the increase in the 10 year bond yield, you got destroyed this week. The 10 year bond yield was near the recent high as it closed at 2.91% on Thursday while stocks increased again. The S&P 500 increased 1.21% and the VIX fell 0.67% to 19.13. The S&P 500 is down 4.93% since the peak meaning it reversed about half of its selloff while the treasuries didn’t reverse at all. I think the stock market selloff was caused by sentiment and a short VIX trade gone wrong. The increasing yields is a good thing because it signals growth is improving. Eventually higher yields will be a problem, especially for the deficit, but we’re not at that point yet.

The High Yield Spread Sometimes Doesn’t React To Corrections

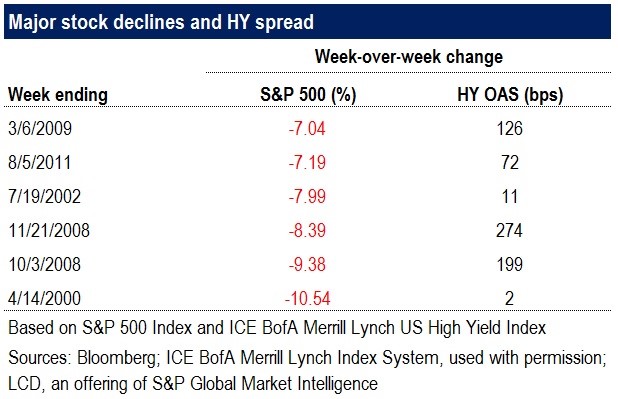

Following my logic that the decline was based on temporary factors rather than the fundamentals, some investors are claiming the high yield spread not confirming the decline means there wasn’t risk of a bear market. While that sounds great because the high yield spread only widened 26 basis points, it’s not accurate to say that high yield bonds always sell off during corrections. As you can see from the chart below, there are a few other periods where stocks crashed and high yield bonds didn’t move. In the tech bubble burst of 2000, stocks fell 10.54%, yet the spread only widened by 2 basis points.

Everything Does Well With Rising Yields

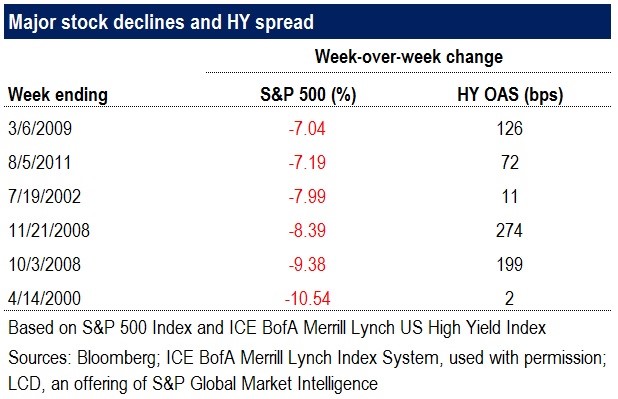

The chart below is a death knell to the argument that stocks must decline when rates go up. As you can see, every style, market cap size, and sector of equities has positive performance when rates rise. This is because rising rates means higher growth. You can see that even real estate and utilities, which don’t like higher rates, have positive performance on average during these periods. The narrative that increasing yields means stocks will fall likely stems from the fact that bonds have been in a bull market for a few decades. Investors forget what rising yields mean. Secondly, investors are concerned with declining valuations. With earnings growth near 20%, even multiple compression can’t stop this market.

Leave A Comment